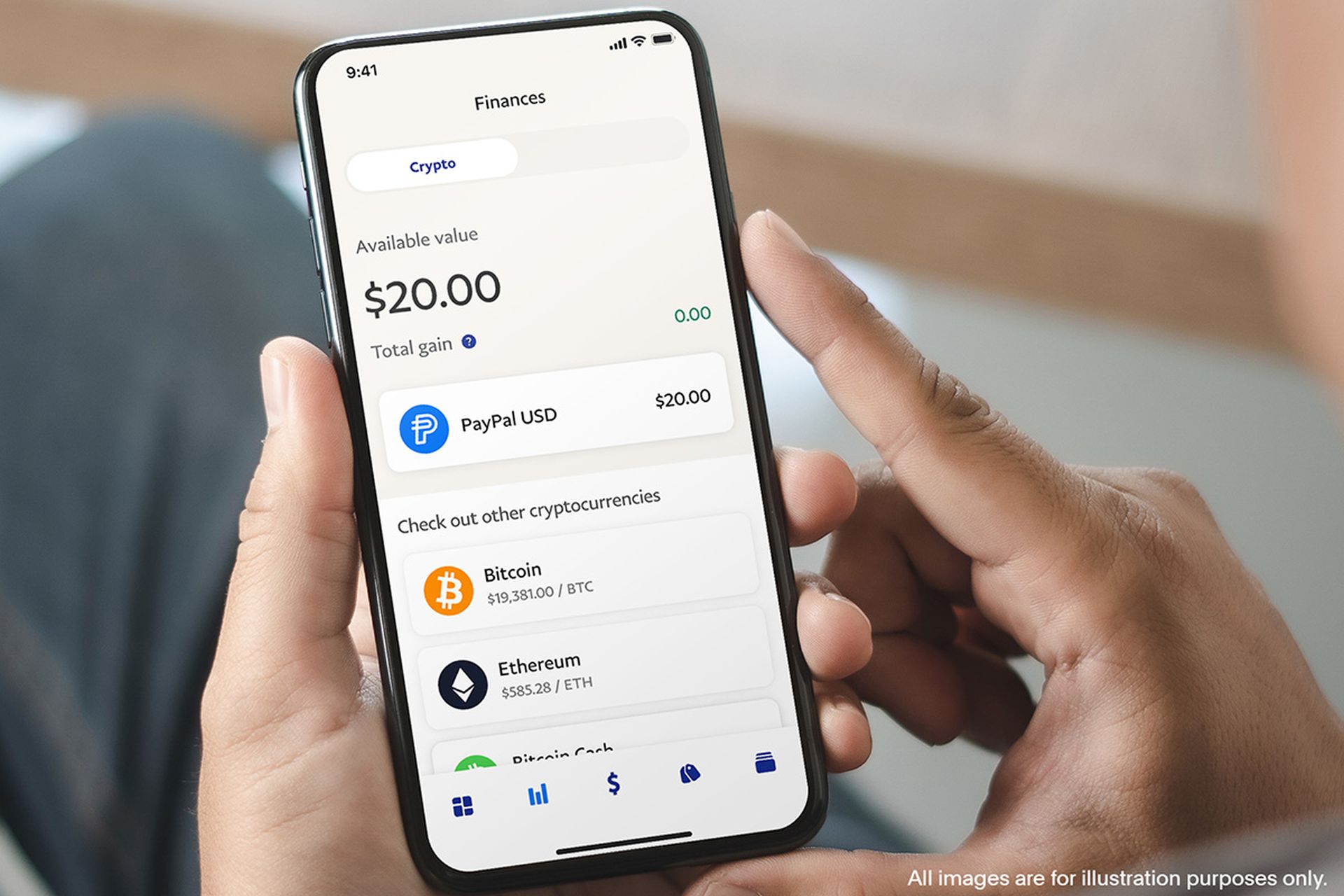

PayPal will issue its own stablecoin, PayPal USD (PYUSD). According to the company, the cryptocurrency token is “fully backed by U.S. dollar deposits” and may be purchased or sold on PayPal’s app or website for $1.00 per PYUSD.

PYUSD can be used to make person-to-person payments, fund purchases at checkouts, and move PYUSD between PayPal and other external wallets. According to PayPal, you can also convert the currencies supported by PayPal to and from PYUSD.

Stablecoins are so-called because they are centralized and backed by current government-backed currencies such as the US dollar or the Euro. The US government is still deciding how to regulate stablecoins and other types of cryptocurrencies. After all, as the collapse of Tether and TerraUSD demonstrated, stablecoins aren’t always that stable.

PayPal stablecoin is now accessible

PYUSD is accessible today and will be available “in the coming weeks” to PayPal Balance customers in the United States. It will also be accessible on PayPal’s Venmo app “soon.”

“PayPal USD will be available to consumers, merchants, and developers to seamlessly connect fiat and digital currencies. As the only stablecoin supported within the PayPal network, PayPal USD leverages PayPal’s decades-long experience in payments at scale, combined with the speed, cost, and programmability of blockchain protocols. As an ERC-20 token issued on the Ethereum blockchain, PayPal USD will be available to an already large and growing community of external developers, wallets, and web3 applications, can be easily adopted by exchanges, and will be deployed to power experiences within the PayPal ecosystem,” the official announcement read.

Today, we’re unveiling a new stablecoin, PayPal USD (PYUSD). It’s designed for payments and is backed by highly liquid and secure assets. Starting today and rolling out in the next few weeks, you’ll be able to buy, sell, hold and transfer PYUSD. Learn more https://t.co/53RRBhmNHx pic.twitter.com/53ur2KmjU7

— PayPal (@PayPal) August 7, 2023

It is issued by Paxos Trust business, a fully licensed limited-purpose trust business subject to New York State Department of Financial Services regulatory scrutiny. After acquiring a conditional BitLicense, PayPal was granted a BitLicense by NYDFS in June 2022.

US dollar deposits, US Treasuries, and comparable cash equivalents fully guarantee PayPal USD reserves. PayPal USD can be bought or traded at a rate of $1.00 per PayPal USD through PayPal.

Rethinking finance through the potential of machine learning in asset pricing

Paxos will begin publishing a public monthly Reserve Report for PayPal’s new initiative in September 2023, outlining the instruments that comprise the reserves. Paxos will also provide a public third-party attestation of the value of its reserve assets available to the public.

An independent third-party accounting firm will grant the attestation, and it will be carried out in compliance with the American Institute of Certified Public Accountants (AICPA) attestation requirements.

Be careful with fake PayPal USD (PYUSD)

Following the launch of PayPal’s stablecoin, the decentralized exchange scanner DEX Screener discovered an intriguing phenomenon: approximately 30 new token pairs with the ticker “PYUSD” appeared within hours. These clones were built on a variety of networks, including BNB Smart Chain, Ethereum, and Coinbase’s newest layer 2, Base, according to Coin Telegraph.

Investors must understand that the genuine PayPal token was established in November 2022, and its authenticity can be checked at a specified contract address. PayPal has said that it can only be transferred between verified PayPal accounts and other compatible wallets. This makes it extremely unlikely that any tokens with the same ticker on sites like UniSwap or other decentralized exchanges are legitimate.

PayPal’s plan to create its own stablecoin is unsurprising, given that the program already allows users to buy, transfer, and sell cryptocurrencies such as Bitcoin, Bitcoin Cash, Ethereum, and Litecoin. Last year, it also received its New York BitLicense, which permits clients in the state to buy and sell cryptocurrencies. In general, the US government has been investigating the development of its own digital currency.

The stablecoin is based on Ethereum and is issued by the Paxos Trust Company, a New York-based company that provides clients with regulated blockchain infrastructure. Paxos was recently told to cease offering Binance’s BUSD coin as New York regulators tighten down on cryptocurrency businesses.

Featured image credit: Muhammad Asyfaul on Unsplash