The recent crypto crash intensified early Monday, drastically reducing the value of major cryptocurrencies like ether, which revisited its December low, and bitcoin, which sank to levels last seen in February. Bitcoin declined by 12% throughout the day and saw over a 20% reduction in value for the week. Meanwhile, ether plummeted by 21% in a single day and 30% over the week, effectively wiping out all its gains for the year and leaving it down by approximately 3% since January 1.

The big crypto crash at a glance

Last week, the cryptocurrency market was riding a wave of optimism, buoyed by former President Trump’s vocal support of Bitcoin. This endorsement not only propelled Bitcoin upward but also lifted the spirits and values of various altcoins. However, the landscape shifted dramatically yesterday when Japan’s stock market opened and immediately plummeted, though the reasons behind this sudden drop remain murky. As a result, cryptocurrencies across the board experienced a sharp decline. In reaction to these unexpected market movements, the Federal Reserve has decided to convene an emergency meeting, signaling the seriousness of the situation and its potential implications on global financial stability.

Bitcoin, Ethereum, altcoins… They’re all crashing

Risk appetite in broader financial markets became more restrained, potentially influenced by the Bank of Japan’s decision last week to raise its benchmark interest rate—a move that might have helped counterbalance the significant drops in both traditional and cryptocurrency markets. This adjustment impacted Japan’s financial markets deeply, with the Nikkei stock index falling over 15% in just three days, and 20% from a mid-July high after an additional 6% decrease early Monday.

In the U.S., the repercussions of the crypto crash and international financial tensions were evident as the Nasdaq composite fell more than 5% during the last two sessions of the previous week. The downward trend continued into Sunday night with Nasdaq futures dropping by 2.5%.

The recent crypto crash has been significantly influenced by the dramatic downturn in Japan’s stock market and the shifting sentiments around Bitcoin. As Bitcoin soared following former President Trump’s endorsement, altcoins also climbed, mirroring Bitcoin’s trajectory. However, the abrupt reversal in Japan’s financial markets sent shockwaves through the global financial world, precipitating a sharp decline in the value of altcoins alongside Bitcoin.

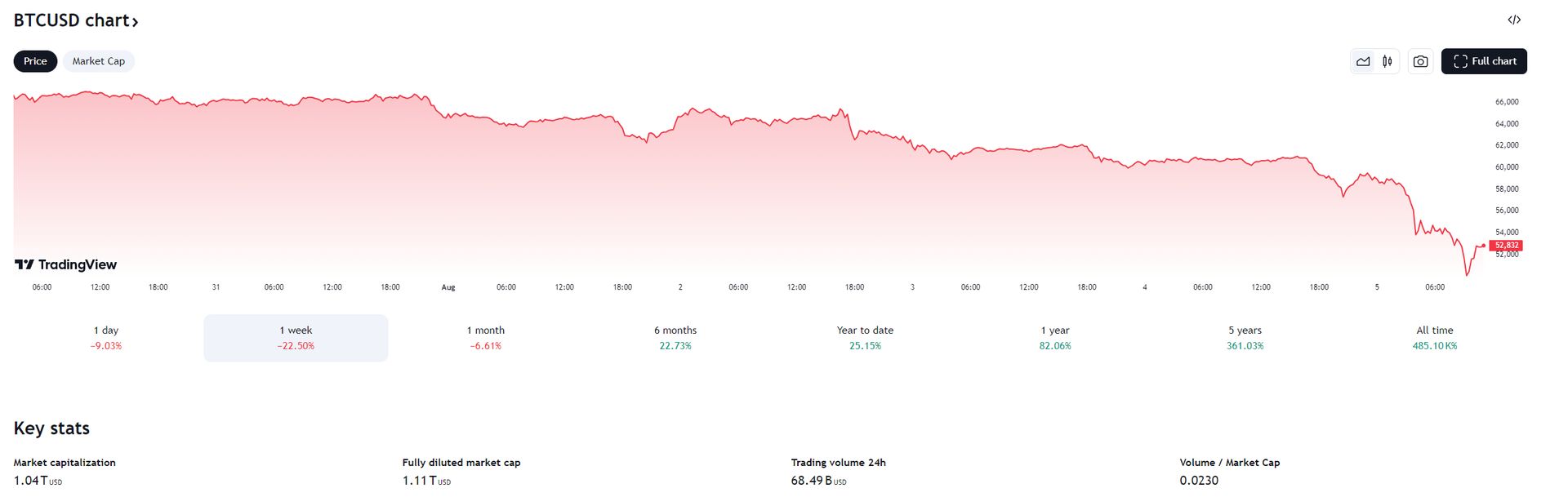

Current Bitcoin pricing

The latest insights from TradingView reveal a continuing downturn for Bitcoin (BTC), which has experienced a decline of 9.03% over the past day, contributing to a 22.50% drop over the past week. As of now, Bitcoin is valued at approximately $52,832. This reflects a broader trend seen over the last month with a 6.61% decline. Despite the recent downturns, Bitcoin still maintains a positive trajectory in the longer term, showing a 25.15% increase year-to-date and a substantial 82.06% growth over the past year. Over the last five years, Bitcoin has achieved an impressive 361.03% increase in value, reflecting its volatile yet upward journey in the cryptocurrency market.

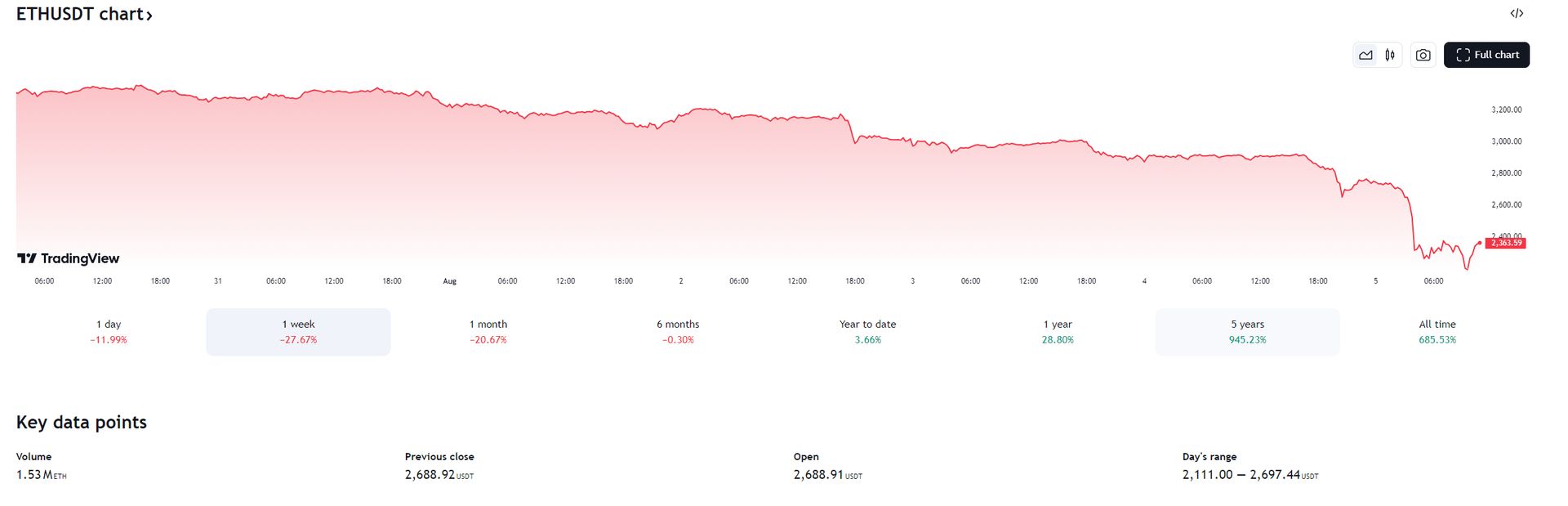

Current Ethereum pricing

Over the past week, ETH has seen a sharp decrease of 27.67%, while the one-month view shows a decline of 20.67%, according to TradingView. As of the latest data, ETH is trading at approximately $2,363.59, marking a significant drop from its previous close at $2,688.92. This downturn reflects broader trends in the cryptocurrency market, which continue to experience volatility amid various global economic pressures. Year-to-date, however, Ethereum still maintains a modest gain of 3.66%, highlighting its resilience despite recent market challenges.

Can Japan market survive this crash?

The financial markets were caught off guard last week, not only by the Bank of Japan’s unexpected shift towards a more aggressive monetary policy but also by the U.S. Federal Reserve’s apparent reluctance to lower interest rates in September—a decision previously anticipated by many market participants. Currently, interest rates hover at a multi-decade peak of between 5.25% and 5.50%, with the Fed postponing any reductions. This hesitation prompted Democratic Senator Elizabeth Warren to urge Fed Chair Jerome Powell to abandon his holiday plans and immediately reduce interest rates, rather than delaying until September, the time most analysts foresee a rate cut.

Typically, lower interest rates boost the appeal of riskier assets, including cryptocurrencies. The uncertainty surrounding the Fed’s forthcoming actions may have led some investors to withdraw from the crypto market, contributing to the recent instability.

FBI has its own precautions now

The FBI has heightened its alerts regarding scammers exploiting the volatility. Specifically, the FBI warns of scammers impersonating employees from cryptocurrency exchanges to deceive individuals into relinquishing their funds. The agency advises against responding to any communications that suggest account issues or compromises, even if they appear urgent and credible. Instead, they recommend verifying any such claims by directly contacting the exchange’s official phone number and avoiding any contact information or links provided by the suspicious caller.

This warning was echoed in a statement on social platform X by the FBI, urging those who have fallen victim to such scams to report the fraudulent activities. The advisory also comes at a time when the crypto market sees a spike in fraudulent activities, with a report from TRM Labs noting that the value of crypto stolen globally in the first half of 2024 more than doubled compared to the previous year. This increase in crypto-related theft is attributed to significant attacks and the overall rebound in cryptocurrency values, particularly highlighting the heightened risk during periods of market instability.

Exploring Japan’s potential to lead global cryptocurrency trends

FED is holding an emergency meeting

The Federal Reserve (FED) is convening an emergency meeting today in response to a substantial correction in Japan’s stock markets. This major financial development is closely watched, given its potential to influence global financial markets. The ripple effects of such a correction are anticipated to reach various sectors, including cryptocurrencies, underscoring the interconnected nature of modern financial systems and the swift impact that regional disturbances can have on worldwide economic dynamics.

Featured image credit: Maxim Hopman/Unsplash