Equifax data breach settlement prepaid card option is being offered to people who are suffering from the the massive hack. After this incident at the consumer credit agency, Equifax, in 2017, millions of people have likely just received an email or letter suggesting they are eligible to claim a class action payout. But how can you be sure the e-mail is legit?

Almost 150 million people had their Social Security numbers, birthdates, addresses, and possibly other personal information stolen after Equifax announced a huge, protracted data breach in 2017. In 2019, Equifax agreed to a settlement that includes up to $425 million to compensate persons harmed by the breach in exchange for the resolution of all remaining class action lawsuits against it. Now, the payback time has come.

Equifax data breach settlement prepaid card: Is it legit?

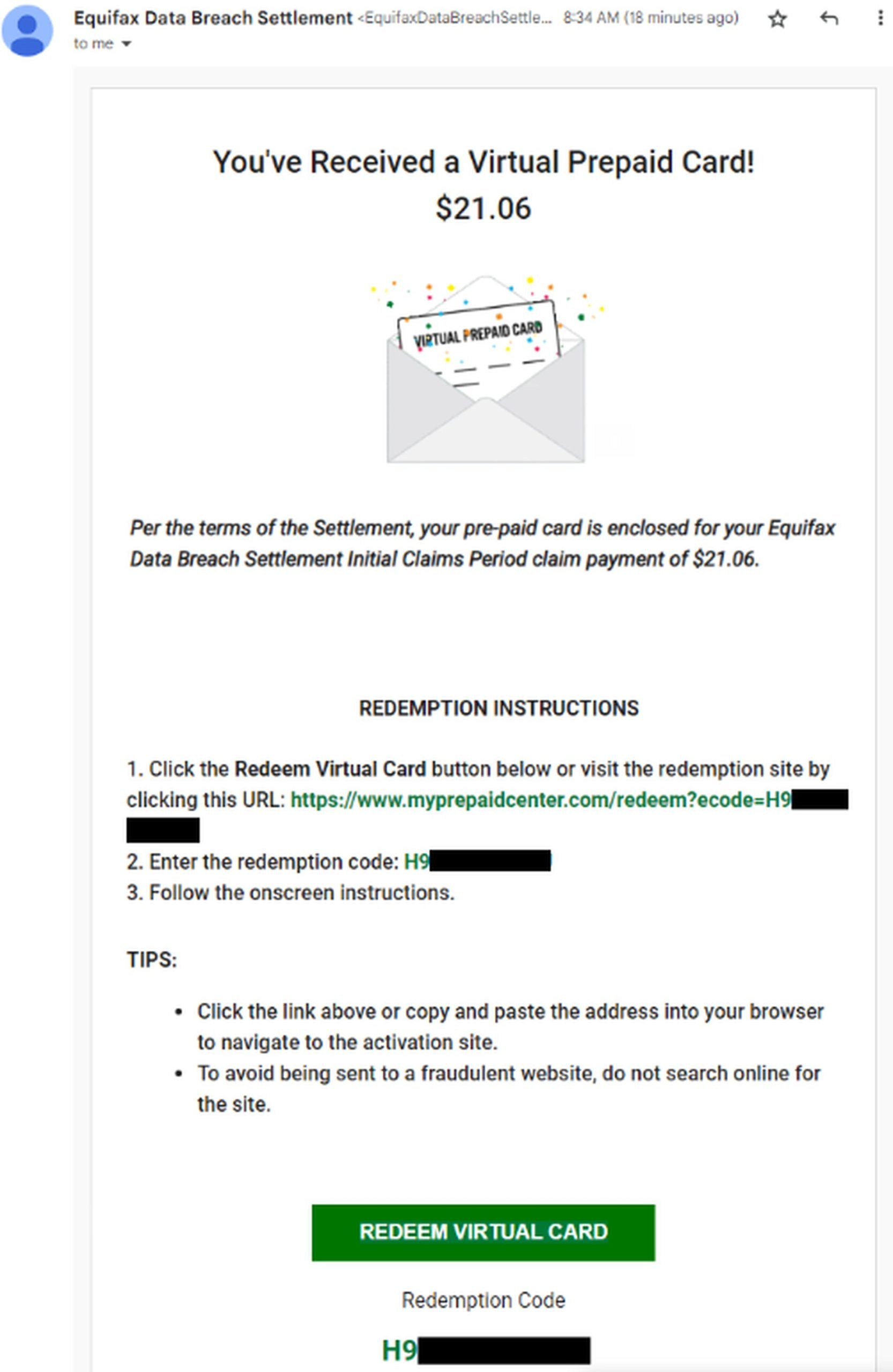

Suppose you’ve received an email claiming to be an Equifax data breach settlement prepaid card announcement but are hesitant to open the linked links. In that case, there is a technique to verify the email’s legitimacy.

Make sure to copy the redemption code in the Equifax data breach settlement prepaid card announcement and then paste it into the search bar on myprepaidcenter.com/redeem. Acceptance of a prepaid MasterCard agreement is required to complete the application process.

You can use your last name and the last six digits of your Social Security Number to see whether or not you were affected by the incident on the settlement page. However, keep in mind that as public awareness about the payouts to deceive people rises, so will the likelihood that phishers and other scammers would attempt to take advantage of this.

You can choose to be paid via check or Equifax data breach settlement prepaid card. Also, you can choose free credit monitoring or up to $125.

Should you pick free credit monitoring or cash?

Credit monitoring services are provided at no cost as part of the settlement. You’ll receive $1,000,000 in identity theft insurance, free credit monitoring for up to six more years from Equifax, and at least four years of credit monitoring at all three major bureaus (via Experian). If you were under the age of 18 in May of 2017, you are entitled to free credit monitoring for the next 18 years.

Credit monitoring and protection services typically last for six months, but you can ask for a cash payout of up to $125 if you already have them. The real sum you receive, however, will likely be significantly less.

It’s tempting to go with the $125 cash option if you already have credit monitoring services that will keep you covered for at least another six months. However, free credit monitoring for 10 years is the superior option in most instances. The average monthly fee for a credit monitoring service is $30.

A credit monitoring service’s ten-year value starts at $1,200. This is far more than $125. Not many people keep up with a credit monitoring service for so long. You might feel more at ease knowing that your credit is being monitored for the next decade if you are concerned about the fraud and identity theft. Your choice of Equifax data breach settlement prepaid card or free credit monitoring, in the end, is entirely up to you.

Over 4.5 million applications for the (potential) $125 cash award have been submitted as of December 1, 2019. Since just $31 million was set aside for compensation, the average payout to each claimant will be closer to $7.

Other settlements that made the news this year: Epic Games settlement, T-Mobile data breach settlement, Equifax Data Breach Settlement, ATT settlement, Tiktok data privacy settlement, Snapchat privacy settlement, and Google location tracking lawsuit settlement

Equifax data breach summary

It’s been a long time since 2017. Let’s remember the Equifax data breach briefly.

Equifax, a credit reporting service, announced on September 7 that a data leak had occurred in one of its computer networks, compromising the personal information of 150 million clients.

It held sensitive information such as names, addresses, dates of birth, Social Security numbers, and credit card details, making it vulnerable to identity theft and other forms of fraud.

Equifax settlement timeline:

- July 2019: Equifax had agreed to pay at least $575 million and maybe up to $700 million, according to the FTC.

- January 2020: The court gives final approval to the settlement.

- Amount of actual settlement: $425 million (Equifax Breach Settlement)

- January 2022: Settlement completed (FTC)

- February 2022: The settlement administrator delivers activation codes to qualified customers who choose free credit monitoring services.

- Fall 2022: Benefits for eligible out-of-pocket expenses associated with the breach or identity theft resulting from the breach, as well as time spent (up to 20 hours) regaining control over the data breach, begin to be distributed to customers by the settlement administrator.

Data breaches and hacks are today’s biggest problems. Check out the latest data breaches and hacks before we continue: CHI Health data breach, Facebook data breach, Uber security data breach, American Airlines data breach, Medibank cyber attack, and Binance hack.

What is Equifax?

One of the three biggest consumer credit reporting companies, together with Experian and TransUnion, is Equifax Inc., an American multinational company with its headquarters in Atlanta, Georgia (together known as the “Big Three”).

Equifax gathers and combines data on more than 88 million organizations and over 800 million individual consumers worldwide. Equifax offers credit monitoring and fraud prevention services directly to individuals and provides businesses with demographic and credit data and services.

Equifax operates or has financial interests in America, Europe, and Asia Pacific. Equifax, which has more than 10,000 employees globally and generates US$3.1 billion in yearly revenue, is listed on the NYSE under the name EFX.