Start-up admiration and entrepreneurship are alive and well outside of Silicon Valley. Check out Berlin, London or Amsterdam and you’ll be met with a striking number of founders, start-up hoppers, and entrepreneurs. Silicon Valley does reign supreme, but the tides are continuing to turn outside of the California-bubble. In fact, 6.9 billion USD was raised in the first half of 2015 in Europe—that’s 86% higher than the same period in 2014. There seems to be few signs of slowing down, especially in the FinTech industry. If industry insiders foresee an imminent burst in the Silicon Valley tech bubble, what’s to stop European start-ups from getting ahead?

American and European start-ups operate on very different playing fields. It’s not that Europe simply has less talent or interest; rather, they have a different set of hoops to jump through. The most notable is funding.

Finding Funds in the EU

The problem is not that the EU has proved unprofitable. With funding largely focused in the US, many European start-ups are quite simply strapped for venture capital: “There have been 24 billion dollar plus exits in Europe in the last five years,” explains Venture Capitalist Fred Wilson. “When you take all of that and combine the fact that there is probably a hundredth of the VC dollars at work in Europe vs the US, you get a great market to invest in.”

The American start-up style is often “go big or go home.” They launch with a fury of marketing campaigns, and reach in every direction manageable. They have to penetrate the market if they ever want to gain an advantage and grow. VC’s fund explosive campaigns in hopes of getting a slice of a unicorn pie. When that fails, there are still plenty of other projects. Europe, however, does not excel at late-stage funding. If a start-up wants to succeed, they need revenue, not market penetration. Perhaps that’s another reason so many are flocking to Berlin, whose unofficial motto “poor but sexy” sums up the financial mind set of many inhabitants. This understanding of start-up growth may also be the culprit behind the lack of exits in the EU.

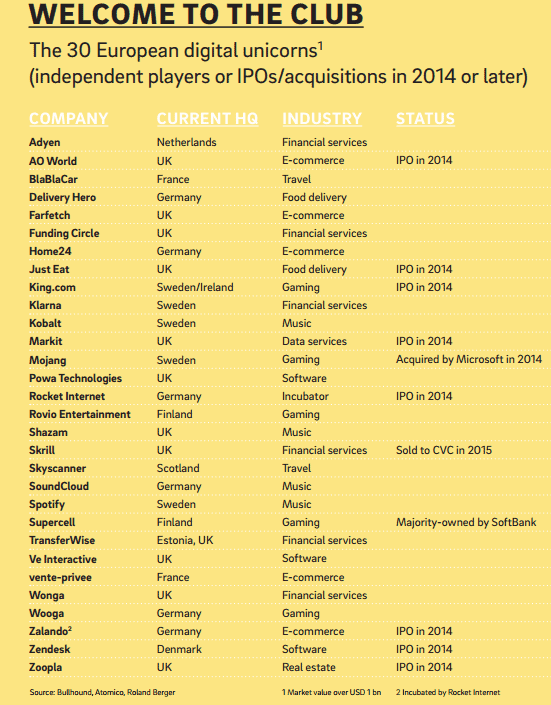

One reason Silicon Valley seems to take the cake over Europe is the number of exits and acquisitions. It seems obvious: if Europe had better start-ups, more corporations would buy them out. European unicorns are completely dwarfed by those in America. Whereas Europe boasts an estimated value of roughly $110 billion, US Unicorns estimate at $700 billion. Despite the growing hubs and interest in Europe, those numbers are tough to accept.

Europe is, however, growing. Seven companies completed successful IPO’s in 2014. They aren’t all explosive companies like Facebook, but they are powerful players, nonetheless. Consulting firm Roland Berger suggests that we “think of German start-ups such as Sociomantics and Rhode-codes: There may be more sexy companies out there, but their business models plug important gaps in the market.”

The Double-Edged Sword of Language and Borders

There’s another interesting set-back for Europe: language. Many start-ups blossom in their home country. They might become big fish in a comparably small pond. While start-ups in the US can expand all across the country with relative ease, even into Canada, the UK, and markets that accept English as the working language, expansion is much more difficult. While some start-ups can operate entirely in English, others have a more local focus. Even for a continent with relatively high English language penetration, the mother tongue aspect is important, especially in privacy-heavy areas like FinTech. Start-ups may start in German, French or Spanish, and translating everything into another language is a huge step. Basic “Google Translate”-styled localization won’t do. Terms, buzzwords, marketing all has to be perfectly translated into multiple other languages. Customer service has to be immediately expanded into several different language divisions. It’s not only a matter of legal borders in Europe, but linguistic ones.

This has been a blessing in disguise for several start-ups. While american start-ups gain traction quickly, they seldom understand the art of expansion. Having made it in Silicon Valley, the assumption is that the product will boom elsewhere, and the intricacies of expansion are over-estimated. European start-ups that have already dealt with the legal, operational, and hidden fees of expanding across borders have necessarily already learned much more about markets and strategies than their American counterparts.

The Powerful Role of FinTech

One field that is really blossoming in Europe is FinTech. London has become a hub, and it continues to grow. However, the style of innovation in Europe differs greatly from across the pond. They haven’t adopted the “fail fast, fail often” attitude of Silicon Valley. Instead of risking failure and stigmatization, companies who do “make it” often prefer to work within the U.S.’s existing start-up machine. They are built to sell and exit to American companies, because that is a safe route. The result is that they exit quickly, preferring security to fully developing their product and company.

Hopefully they are ready to fill some big shoes, because London’s FinTech sector is projected to continue climbing, and even to surpass that of Silicon Valley. Accenture and CB Insights have found that, while the majority of funds still go to the US, London’s five-year trajectory has outpaced the competition. FinTech investment is growing worldwide, but Europe experienced the highest growth rate, with an increase of 215 percent to $1.48 billion in 2014, 42% of which was in the UK and Ireland, alone.

As prices in Silicon Valley soar and many expect its tech bubble to burst, the scene is changing in Europe. With more capital, and the push of the FinTech industry, US and EU start-ups may find themselves on somewhat closer footing. Still, despite plans to build the world’s largest incubator in Pairs, and significant growth in hubs like London and Berlin, Europe will not simply replace Silicon Valley. They must continue to take advantage of Europe’s unique opportunities, and set themselves apart from the American system.

image credit: TechEU

Like this article? Subscribe to our weekly newsletter to never miss out!