Nvidia’s (NASDAQ: NVDA) stock price may be poised for a rebound, with technical indicators suggesting a potential turnaround following a series of turbulent trading sessions. As of the last trading session, Nvidia closed at $112.69, gaining 1.9%. Despite this uptick, the stock remains under pressure, down nearly 9% for the week and 18% year-to-date.

Update: Meta just tested its own AI chip: Is Nvidia in trouble?

Nvidia’s technical analysis suggests potential rebound

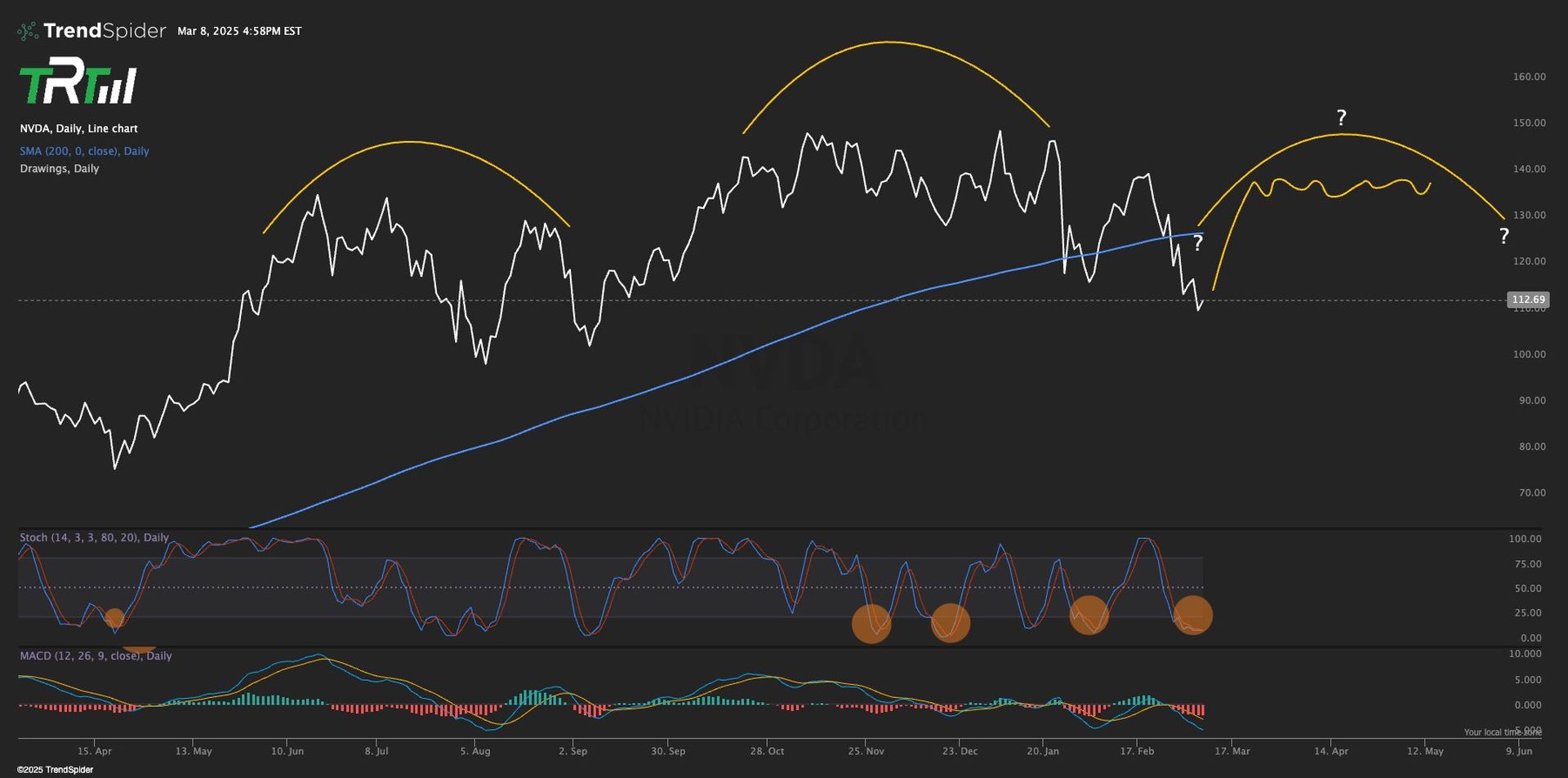

According to trading platform The Rock Trading, NVDA may be setting up for a bounce after experiencing recent oversold conditions. Their March 9 analysis indicated that the stock could rally toward the 200-day moving average (MA) near $127, with a potential push to $143 if momentum holds. The analysis shows that Nvidia’s stochastic relative strength index (RSI) has exited deep oversold territory, which historically signals strong rebounds. Additionally, the MACD indicator demonstrates weakening selling momentum, further supporting the possibility of a short-term rally.

However, analysts warned that NVDA may be forming a head-and-shoulders pattern—a bearish reversal signal—which suggests that any recovery could be short-lived before facing a deeper decline. Market Maestro highlighted increased volatility and a potential trend shift for Nvidia’s stock, noting that NVDA is testing a critical support zone between $112 and $128, designated as a “fair value gap.” A breakdown below this range could lead to prices falling to $110 or even $70, while a strong rebound could push the stock back toward the significant resistance level of $150.

The RSI has dropped to 41.38, nearing oversold territory, while rising volume indicates increased selling pressure, adding uncertainty to the stock’s trajectory.

Nvidia’s fundamentals and revenue growth

Nvidia has exhibited lackluster stock performance despite reporting record revenue. For the fiscal fourth quarter, the company posted $39.33 billion in revenue, surpassing the estimated $38.05 billion, with net income soaring to $22.09 billion, almost doubling from the previous year. The data center segment, now accounting for 91% of total sales, generated $35.6 billion, up 93% year-over-year. Blackwell, Nvidia’s next-generation AI chip, contributed $11 billion in revenue and is seeing the fastest adoption in the company’s history. Nvidia projects $43 billion in first-quarter revenue, implying 65% year-over-year growth.

Again, Nvidia stock drops 9%: How bad could it get?

Despite concerns regarding slowing expansion and competition from custom AI chips, Nvidia maintains confidence in its market position. The company is banking on Blackwell chips to foster the next wave of AI innovation. These chips deliver four times faster AI training, making AI inference twenty times cheaper than previous models. Although the ramp-up in production has temporarily affected gross margins, Nvidia expects this short-term issue to rectify as efficiency enhances.

Following its February 26 earnings report, Wall Street remains mostly bullish on Nvidia stock. BofA Securities raised its price target to $200 from $190, maintaining a ‘Buy’ rating. Analyst Vivek Arya emphasized Nvidia’s leadership in AI compute and inference applications, citing Blackwell’s impressive $11 billion in sales, significantly higher than the anticipated $4 to $7 billion range. JPMorgan reaffirmed its $170 price target and ‘Overweight’ rating, citing robust customer demand for AI compute and an accelerated ramp-up of Blackwell. Raymond James also upheld its $170 target, noting that Blackwell’s revenue is already exceeding its predecessor, Hopper, with increasing demand for inference tasks such as DeepSeek requiring more compute power.

Needham retained its $160 price target, commending Blackwell’s outperformance despite earlier concerns of overheating. Analyst Rajvindra Gill adjusted gross margin estimates down by 100 basis points, predicting a slower recovery to approximately 75%. Rising demand for inference is expected to bolster Nvidia’s AI momentum.

In contrast, Summit Insights downgraded Nvidia stock to ‘Hold’, reflecting an unfavorable risk-reward balance. Analyst Kinngai Chan warned of decelerating growth in the latter half of FY26 as GPU supply aligns with demand.

Nvidia has experienced significant growth, with the stock returning 1,604% over the past five years. The latest financial trends show that for the fiscal year ending January 26, revenue climbed by 114% year-over-year, propelling adjusted earnings per share (EPS) to $2.99, a 130% increase from the previous year. Analysts expect another 56% revenue growth this year, with an EPS target of $4.50 in fiscal 2026. Currently, Nvidia is trading at a forward price-to-earnings (P/E) ratio of 26, substantially lower than its five-year average of over 70, indicating that the stock appears undervalued amid sustained demand for its AI chips.

Disclaimer: The content of this article is for informational purposes only and should not be construed as investment advice. We do not endorse any specific investment strategies or make recommendations regarding the purchase or sale of any securities.

Featured image credit: Kerem Gülen/Ideogram