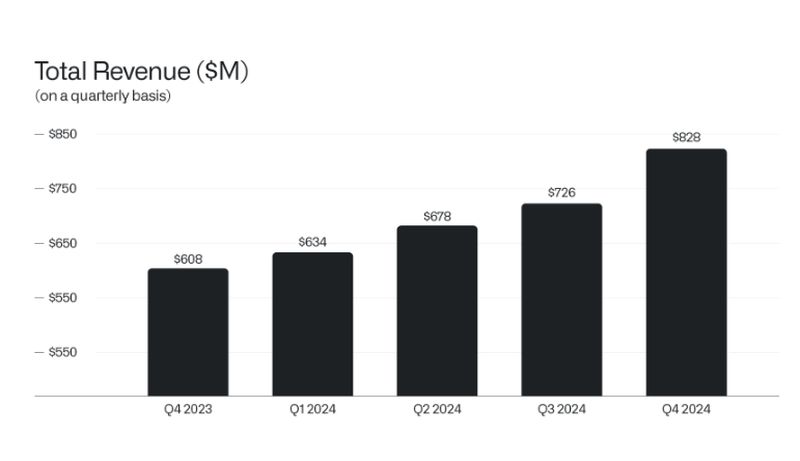

Palantir shares surged as much as 22% in extended trading on Monday after the software company reported fourth-quarter earnings and revenue that surpassed Wall Street’s estimates. The company posted earnings per share of 14 cents, adjusted, compared to the expected 11 cents, and revenue of $828 million versus the anticipated $776 million.

Palantir stock jumps 22% after strong Q4 earnings

Along with the fourth-quarter beat, Palantir offered better-than-expected guidance, projecting revenue between $858 million and $862 million for the first quarter of 2025, ahead of an LSEG estimate of $799 million. For the full fiscal year, the company forecasts sales between $3.74 billion and $3.76 billion, exceeding the $3.52 billion average estimate from analysts.

How 2025 looks like for Palantir stock

Palantir, a prominent provider of software and technology services to defense agencies, attributed much of its growth to its use of artificial intelligence. CEO Alex Karp noted, “Our business results continue to astound, demonstrating our deepening position at the center of the AI revolution. Our early insights surrounding the commoditization of large language models have evolved from theory to fact.”

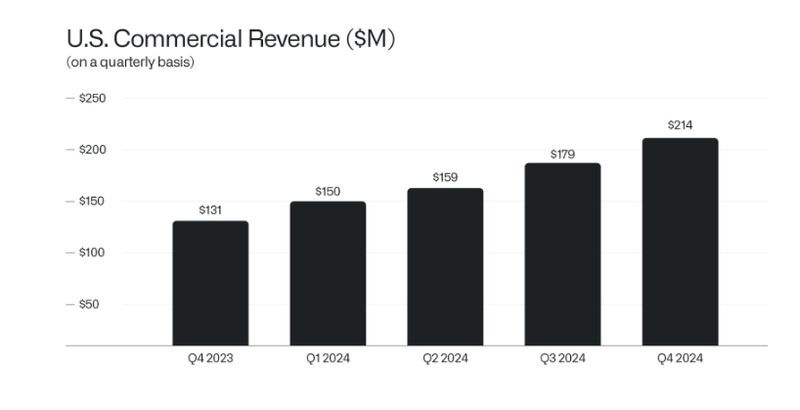

Revenue for the fourth quarter increased 36% from $608.4 million a year earlier, while full-year sales rose by 29%. Karp remarked that the company’s momentum is “unlike anything that has come before.” U.S. commercial revenue grew 64% to $214 million, and U.S. government revenues increased 45% year over year to $343 million. The company expects U.S. commercial sales to grow at least 54% to about $1.08 billion in 2025.

Karp mentioned, “We are still in the earliest stages, the beginning of the first act, of a revolution that will play out over years and decades,” emphasizing that Palantir has “been preparing for this moment diligently for more than twenty years.” Palantir’s stock surged 340% in 2024, and it joined both the S&P 500 and Nasdaq 100 last year.

The company has benefited from the boom in generative AI following the release of OpenAI’s ChatGPT in late 2022. In a CNBC interview last week, Karp stated that Palantir is poised to lead the transformation of American companies and maintained that bolstering the U.S. is its “primary objective.”

In addressing concerns over China’s emerging technology, particularly the DeepSeek AI model, Karp remarked, “Technology is not inherently good. We have to acknowledge that, but that also just means we have to run harder, run faster, have an all-country effort.”

Palantir recorded a net dollar retention rate of 120%, representing a 200 basis point increase from the previous quarter. The company reported an adjusted operating margin of 45%, the highest in its history, and a total remaining deal value of $5.43 billion, reflecting a 40% year-over-year increase.

For the fourth quarter, adjusted free cash flow totaled $517 million, yielding a margin of 63%. The company closed $1.8 billion in total contract value (TCV), marking a 56% increase year over year. U.S. commercial TCV booked reached $803 million, a 134% growth year over year. Customer count increased by 43% year over year to 711 customers, with top 20 customers generating an average revenue of $65 million each, an 18% year-over-year increase.

Despite the impressive financial results, Palantir faces challenges as international commercial revenue growth remained modest at 3% year over year in Q4. Additionally, the European market showed slower growth, achieving only 4% growth on 13% of the company’s business, as the company encounters cultural and strategic differences in expanding its presence in Europe.

Palantir’s leadership acknowledged that revenue from strategic commercial contracts is expected to decline significantly in Q1 2025 and anticipated increased expenses in 2025 due to investments in technical hires and the product pipeline. The company seeks to maintain its edge through its unique ontology, enabling the development of software across various industries securely.

Shyam Sankar, Palantir’s chief technology officer, highlighted ongoing competition in the AI sector, emphasizing, “We are in an AI arms race,” particularly referencing the progress made by China’s DeepSeek. Sankar pointed to the necessity of a coordinated national effort to address the challenges presented by these technological advancements.

Palantir’s net income for Q4 was reported at $79 million, with a GAAP earnings per share of $0.03 for the quarter. Adjusted earnings per share stood at $0.14 in Q4 and $0.41 for the full year. As of the end of Q4, cash and equivalents totaled $5.2 billion.

The 22% stock surge is grabbing attention, but the real indicators of Palantir’s strength lie elsewhere. A $5.43 billion remaining deal value underscores long-term stability, showing that revenue isn’t just growing—it’s secured. For those focused on expansion, the 134% year-over-year growth in U.S. commercial contract value highlights accelerating demand in a key market. On the profitability front, a 63% adjusted free cash flow margin signals operational efficiency at scale. And with a 43% increase in customer count, adoption is clearly on the rise. While the stock movement reflects immediate market reactions, these fundamentals provide a clearer picture of where the company is headed.