- The Singapore High Court decided in its first written judgment on an NFT that non-fungible tokens can be considered property.

- The decision is in the matter of Janesh Rajkumar, who is trying to retrieve the BAYC No. 2162 NFT, which he used as collateral for a loan from “chefpierre.”

- Justice Lee went on to clarify that his decision was based on an interlocutory application, which is a pre-trial request for a court order on procedural concerns, and that it should be read in that light.

In its first written ruling regarding an NFT, the Singapore High Court declared that non-fungible tokens (NFTs) can be deemed property. NFTs are tokens that reside on blockchains, which are decentralized digital ledgers. They may be used to represent underlying assets such as artwork, films, and music, which can be digital or real.

Details of the NFT lawsuit

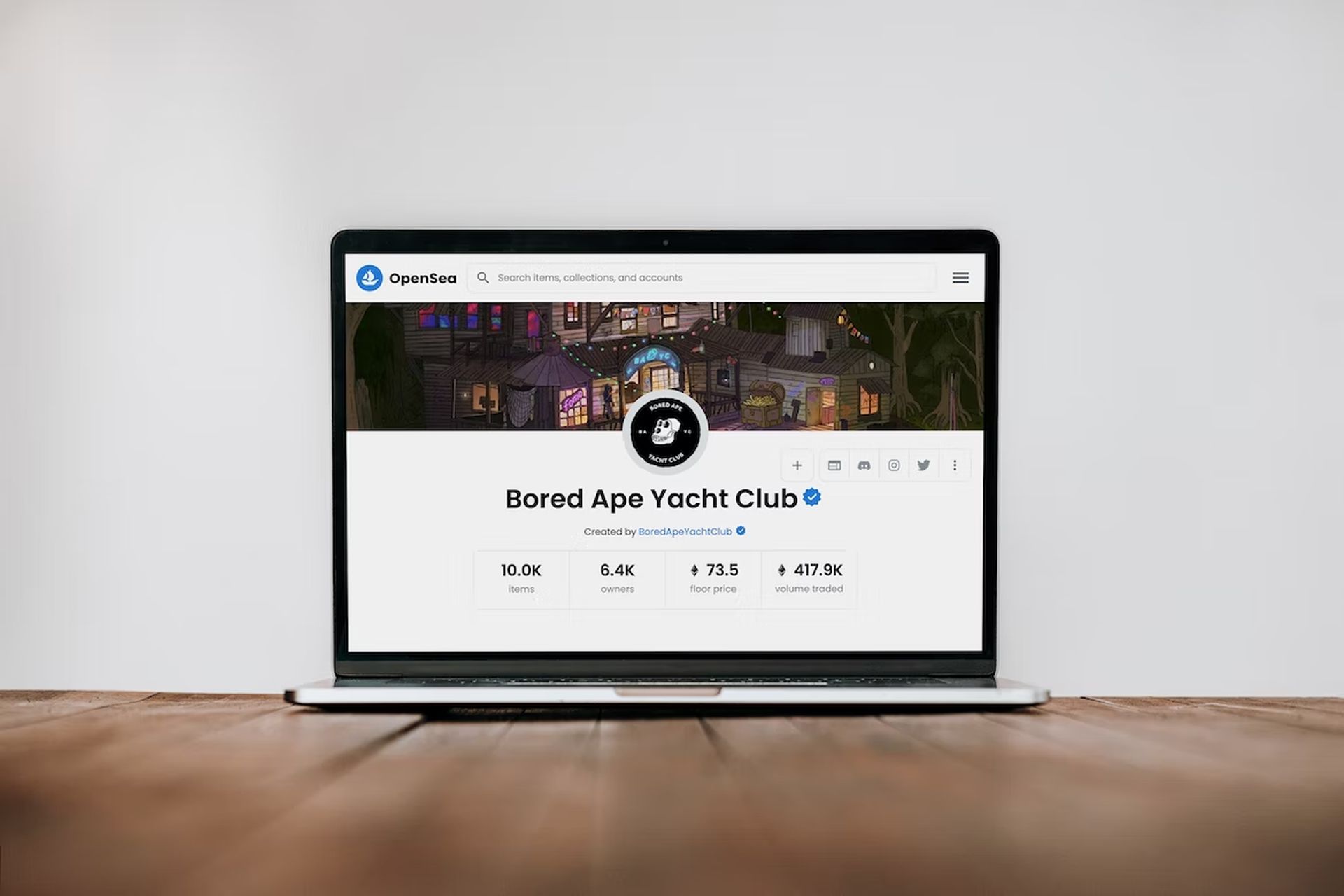

First, let’s go through the facts of this case. Janesh Rajkumar is attempting to reclaim the Bored Ape Yacht Club No. 2162 NFT, which he used as security for a loan from “chefpierre.” He claims, among other things, that he is the real owner of the non-fungible token and that “chefpierre” unlawfully took it from him.

Mr. Janesh alleged in his statement of claim that he previously purchased the Bored Ape non-fungible token with the purpose of keeping the token for himself. He also stated that it is a very uncommon item, even among BAYC non-fungible tokens, due to its characteristics, which include the possibility of producing a new non-fungible token of another special series. Due to its scarcity and high monetary worth, Mr. Janesh would frequently use BAYC No. 2162 as collateral to borrow cryptocurrencies on a platform known as NFTfi.

Reversible blockchain transactions might be the solution against fraud and money laundering

The decision of the Singapore High Court

In his judgment grounds, Justice Lee Seiu Kin stated that NFTs might be regarded as property if they met certain legal standards, such as being readily distinct from one another and having owners who can be recognized as such by third parties. He gave the grounds to explain why he granted an injunction in May to prevent the sale and transfer of a non-fungible token.

However, he emphasized that the injunction application was urgent, and one of the parties in the case was not needed to be present at the court hearing, so he did not get to hear arguments from that side.

Justice Lee went on to say that his judgment was based on an interlocutory application, which is a pre-trial request for a court order, generally on procedural issues, and that it should be interpreted in that context. “A different conclusion may well be reached with the benefit of fuller submissions,” he stated.

Mr. Janesh Rajkumar, a Singaporean, requested it to safeguard a non-fungible token known as Bored Ape Yacht Club (BAYC) No. 2162. BAYC is a limited edition series of non-fungible tokens, each with a unique ape with facial expressions, dresses, and accessories. Mr. Janesh is attempting to reclaim BAYC No. 2162 from an internet persona known as “chefpierre,” whose identity is listed in court filings as unknown. His case, which began in Singapore, is still underway.