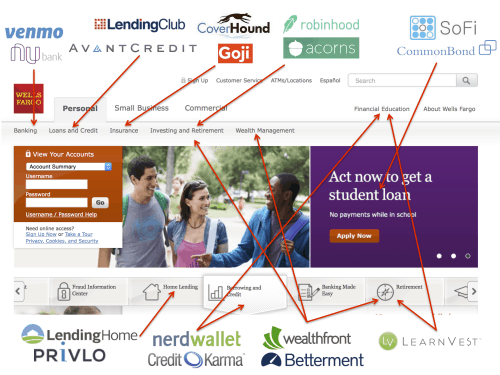

Traditional, centralized banks may be miserable at keeping power in check and satisfying customers, but they do have a convenient side. Banks are one-stop shops for accounts, loans, transfers, investments, and other consumer products. While FinTech companies are finally giving each area of banking crucial attention and updated technology, they’re also naturally eroding at centralization in the process. This necessary “unbundling” of financial services contradicts our love for having everything in one place. So, what will happen when the network of disparate FinTech services becomes too inefficient for consumers and businesses?

If our mobile culture and on-demand desires indicate anything about the future of financial services, it’s this: The updated products and services within FinTech will likely get re-bundled into a single platform – a Frankenstein FinTech bank, of sorts. This time, however, the result will be starkly different than the banks we know.

What does the FinTech bank look like?

Trends in FinTech hint at an aggregated future platform that’s entirely digital, mobile, and hyper-connected – eliminating the need for physical branches altogether. Algorithms perform budget, savings, and investment management, as well as monitor trends and track account security. Intuitive and accessible interfaces display real-time information. Finally, all of this is available at affordable rates and without hidden fees. Like Facebook’s tendency to evolve social networking features keeping with technological advancements, so does the FinTech bank with financial tools.

How close are we to a FinTech bank?

Germany’s Number26 already touts itself as “Europe’s most modern bank account,” and with reason; its 3-step, 8-minute account setup process, free price tag, simple digital account management, and other convenient perks make it an intuitive and overall pleasant experience for customers. Similarly, Simple Bank in the US describes its user experience as “the way banking should be.” Even so, neither bank has everything yet – and both actually rely on traditional banking models to function.

The fully evolved modern FinTech bank might also include the savings tools of Digit, comprehensive budgeting of Mint, cost-effective transfers of TransferWise, wealth management of Betterment, loans of LendingClub, and investment management of Nutmeg. Business and merchant services would include payment platforms such as Square and Braintree, advanced payroll services in the style of ZenPayroll, and investment networks from LendingCircle. But unlike many of these existing FinTech services, the FinTech bank’s editions would be entirely build upon a new financial infrastructure beneath a single umbrella entity.

If you find yourself interested in what’s to come, it might be wise to monitor banking apps such as Number26 and other newcomers to see how they evolve their technology and incorporate new features.

Do you think FinTech is headed toward a new, bundled bank? Let us know in the comments.

(Image sources: Eric Webster via Creative Commons and Tom Loverro)