Blockchain: the single most confusing term since Bitcoin. Everyone has a vague idea of what it does. It’s either the ultimate evolution of financial technologies, or a silly fad that can be summed up in the disconcerting phrase: “dogechain.” In reality, major companies around the world have already shown favor to the burgeoning money exchange system and it may become harder and harder to stay away from the financial dark art.

In reality, it is all relatively easy to understand. The Blockchain is a public ledger where transactions are recorded and confirmed anonymously. It’s a record of events that is shared between many parties. More importantly, once information is entered, it cannot be altered. So, if the blockchain is the public record, what is being recorded? What are all of these “transactions”?

Cryptocurrencies, like bitcoin, are currencies that exist solely in digital. There are no physical golden coins with a big “B” on them. Moreover, owning these non-real coins entails a new idea of “ownership.” You don’t literally have it in your hands, or even in your bank account, but you have the ability to transfer “ownership” to someone else simply by creating a record in the blockchain. Rather than using bills, your transfer is pure data.

Where exactly is this chain located? Due to the open nature of cryptocurrencies, and the importance of the public having access to other blocks, the blockchain isn’t located on just one guy’s large computer. For example, the bitcoin blockchain is actually managed by distributed nodes. These nodes all have a copy of the entire blockchain. Nodes will forever come and go, synchronizing their own copies of the chain with those of other users. By distributing copies and access, the chain can’t simply “go down,” or disappear. It’s a decentralized system that is both sturdy and secure.

All of your dogecoins are in a row, but what do you do with them? Whether you’re using them IRL or online, the blockchain makes it happen. There are many reasons people are falling in love with cryptocurrencies: it’s anonymous, decentralized, and there are no fees or third parties trying to grab a percentage. However, if there were absolutely no regulations in place, the new currency would quickly become a greedfest of users trying to screw each other over. The public nature of the blockchain means that anyone can check it. It is effectively anonymous, yet public, simultaneously, and it is in the best interest of users if it remains so.

You can accept and trade coins, or you can mine for them. Miners can spend thousands of dollars on the right equipment just to mine coin. But what do they really do? What miners do is quite similar to real-world miners in that they are actively looking for something. Their computer repeatedly works through complex calculations to find a very specific answer.

Miners solve problems, but how in the world is that helpful? Short story, miners are actually verifying that transactions posted by other users are legitimate, and the numbers all add up. Long story…

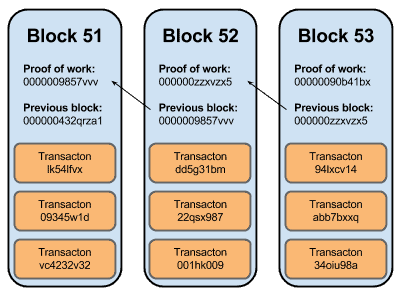

Miners collect transactions and put them into a single block. A block generally contains four pieces of information: a reference to the previous block, a summary of included transaction, a time stamp, and Proof of Work that went into creating the secure block. The blocks are strung together into a chain—a fluid chain that does not allow for any inconsistencies; this means there are no “bad cheques” in the system, and transactions entered are necessarily valid and can be processed. By checking the blockchain and confirming transactions, the entire system is effectively self-regulated and fully secure. No, that doesn’t mean some kid cooped up in a basement can just click “okay” and confirm a billion dollar transfer. Blocks generally need numerous independent confirmations, and the equations are intended to be hard to crack. Not to mention, the hardware required is far more specialized than the average laptop. Finally, what’s to stop someone from simply going back and editing existing blocks? Each block is securely hashed—meaning it is rendered into seeming gibberish and nearly impossible to invert or undo. Once it’s in the blockchain, it’s there forever.

So, why waste time and resources helping other people, or the blockchain? Why not let someone else do all that “confirmation stuff,” while you just mine? Because, you don’t necessarily have a choice. Confirmation of the blockchain is central to mining. It’s part of the actual mining process; however, miners are generally given incentives. For example, after solving a problem (and creating a new hash) they are rewarded with coins.

Will you be seeing a blockchain-styled ledger in your future? Short answer: oh yes. Blockchain and cryptocurrencies have caused quite a stir over the past years. However, it seems their real importance has yet to be fully realized. The future isn’t just in businesses around the globe sporting happy “Now Accepting Bitcoins” signs, but rather emerging companies (and revolutionary existing ones, too) finding new uses for the cutting edge technology. VC firms and investors are placing their bets on the blockchain because there is untapped potential. Identity management, international contracts, and all sorts of complicated bank transactions can be greatly altered with the public ledger system. The process could (in an ideal world) work seamlessly, crossing boundaries where banks, logistics or a plethora of other obstacles once existed. They could be combined with the Internet of Things to create a more connected and automated world. Future companies may be able to absorb mountains of new data, or even digitize real-world things that are hard to quantify. Unfortunately, many big companies are remaining mum on the studies in the blockchain field for obvious reasons.

However, it is public knowledge that nine major banks (including JP Morgan and Goldman Sachs) recently joined a partnership to develop blockchain technologies. That’s not to say major companies are getting in on the cryptocurrency game; rather, they realize that the blockchain system, itself, could be a powerful tool for efficiency. With a system as versatile and secure as the blockchain, there may many unexpected innovations in the coming months and years.

image credit: BTC Keychain, CC2.0)