A recent ransomware attack on Indian banks has sent shockwaves through the country’s financial sector. The attack, which targeted C-Edge Technologies, a key provider of banking solutions for smaller institutions, has disrupted operations at nearly 300 rural and cooperative banks across India.

C-Edge Technologies, established in 2010 as a joint venture between the State Bank of India (SBI) and Tata Consultancy Services (TCS), has been a pivotal force in modernizing India’s banking. The company has played a significant role in providing technological solutions to smaller banks, particularly in rural and semi-urban areas.

However, this ransomware attack on Indian banks has exposed the vulnerabilities in the very systems C-Edge Technologies was meant to secure.

Indian banks got hit by ransomware attacks

The ransomware attack on Indian banks, which occurred on Wednesday, primarily affected rural and cooperative institutions that rely heavily on C-Edge Technologies’ services. As a result of this cyberattack, numerous payment systems experienced outages, leaving customers unable to access various banking services. The National Payment Corporation of India (NPCI) took swift action by temporarily disconnecting C-Edge Technologies from its retail payment network to prevent the spread of the cyber threat.

While the ransomware attack on Indian banks has affected a significant number of institutions, it’s important to note that these banks represent only about 0.5% of the nation’s total payment system volumes. Nevertheless, the impact on rural communities and smaller financial institutions cannot be understated.

C-Edge Technologies’ role in the aftermath

In the wake of this ransomware attack on Indian banks, C-Edge Technologies faces the daunting task of not only addressing the immediate fallout but also rebuilding trust in its cybersecurity capabilities. The company, known for its diverse portfolio of banking solutions, including core banking systems, payment solutions, and ironically, cybersecurity services, must now demonstrate its ability to protect against and respond to such threats effectively.

The ISC chemistry 2024 paper leak shocks India

C-Edge Technologies’ experience in serving underserved markets and driving financial inclusion makes its recovery from this ransomware attack crucial for maintaining progress in these areas. The company’s ability to provide affordable and accessible technology solutions has been instrumental in empowering smaller banks to cater to a wider customer base, particularly in rural areas.

Regulatory response was quick to come

The ransomware attack on Indian banks has prompted swift action from regulatory bodies. The NPCI is currently conducting comprehensive audits to evaluate the damage and prevent further issues. This incident underscores the need for stronger cybersecurity defenses, especially for smaller banks that may lack resources for advanced security measures.

Moving forward, C-Edge Technologies and the broader banking sector will likely face increased scrutiny and demands for enhanced security protocols. This ransomware attack on Indian banks serves as a wake-up call for the entire industry, emphasizing the importance of regular security checks and robust disaster recovery strategies.

As the dust settles on this ransomware attack on Indian banks, C-Edge Technologies faces several key challenges:

- Strengthening cybersecurity: The company must significantly enhance its cybersecurity offerings and address the vulnerabilities exposed by this attack.

- Rebuilding trust: C-Edge Technologies will need to work diligently to regain the confidence of its banking clients and demonstrate its commitment to security.

- Advancing cloud-based solutions: The incident may accelerate the transition to more secure, cloud-based banking platforms, an area where C-Edge Technologies can play a crucial role.

- Leveraging AI and data analytics: Enhancing risk management and fraud detection capabilities through advanced technologies will be essential in preventing future attacks.

The ransomware attack on Indian banks targeting C-Edge Technologies has exposed critical vulnerabilities in the country’s financial infrastructure. As a key player in providing technology solutions to smaller banks, C-Edge Technologies now faces the challenge of not only recovering from this attack but also leading the charge in fortifying the sector against future threats.

The incident serves as a stark reminder of the ongoing need for vigilance and investment in cybersecurity across India’s diverse banking landscape. The response to this crisis will likely shape the future of banking technology and security in India for years to come.

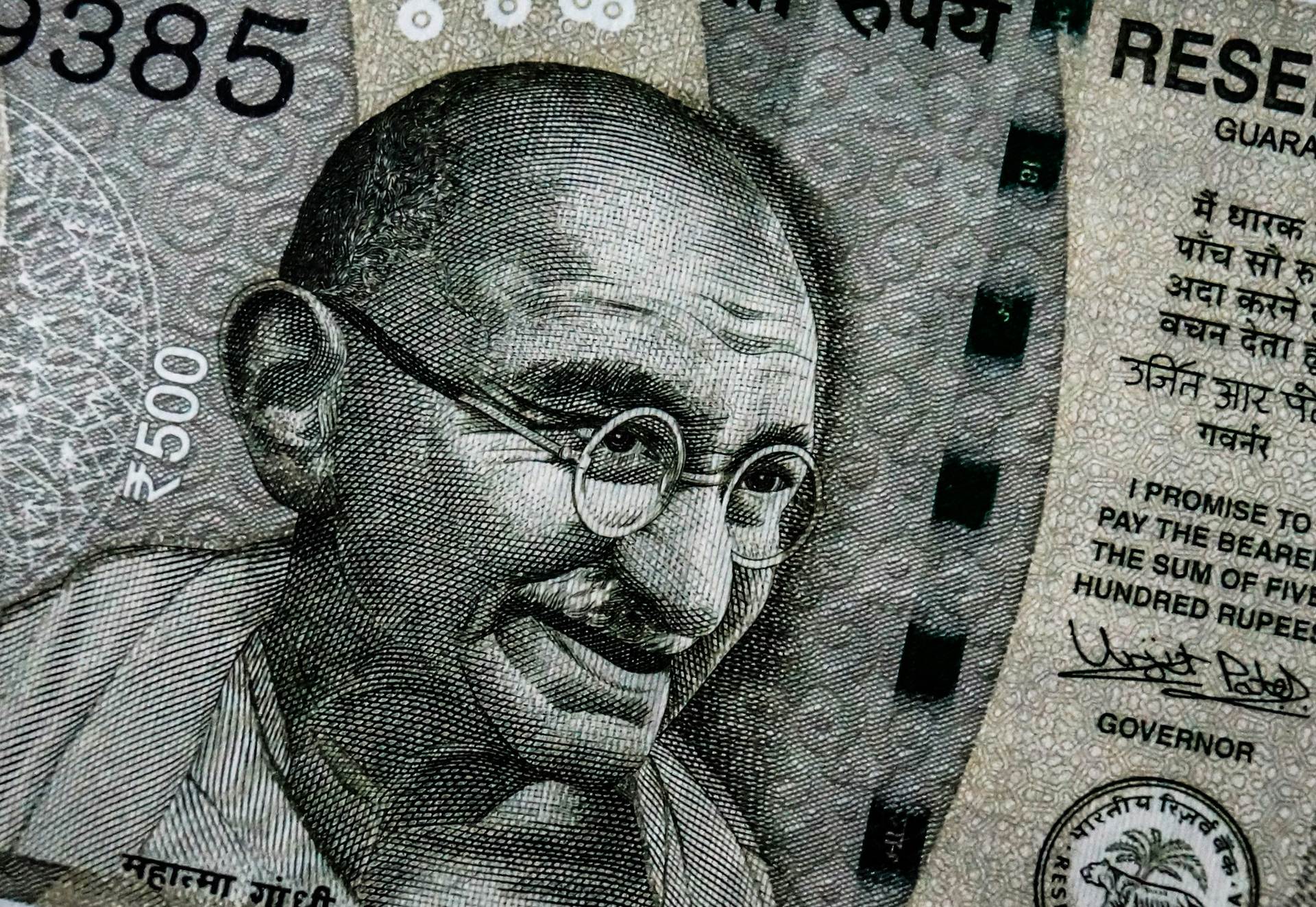

Featured image credit: Syed Hussaini/Unsplash