Are you looking for the best AI ETFs? Artificial intelligence is making waves as it strives to create machines that think and act like humans. And for investors looking to ride this wave, Artificial Intelligence Exchange-Traded Funds (ETFs) offer a convenient way to get in on the action.

So, what are AI ETFs exactly?

They’re investment funds tailored to the AI sector, focusing on companies that are leading the charge in AI innovation. These companies are involved in developing cutting-edge products, advancing technology, and conducting AI research. Some examples include industry giants like Tesla Motors, Apple, and Alphabet.

Artificial intelligence ETFs typically meet one of these criteria:

- Direct investment in AI leaders: They invest in companies at the forefront of AI innovation, whether through new products, services, or research.

- High exposure to AI: These funds have a big chunk of their portfolio invested in companies heavily involved in AI research and development. Think robotics, automation, 3D printing, and more.

- AI-powered selection: Some ETFs use AI themselves to pick which stocks to include, blending finance with cutting-edge technology.

Investors can explore a range of information about artificial intelligence ETFs, from past performance to expenses and technical details. Each AI ETF offers a unique way to tap into the potential of AI and its impact on various industries. But which one is the best to invest in?

Disclaimer: Nothing on this site should be construed as investing, financial, trading, or any other kind of advice. No cryptocurrency, ETF or stock is recommended for purchase, sale, or storage by Dataconomy. Before making any investing decisions, you should do your own research and consult with a financial professional.

Best AI ETFs to look for

When it comes to investing in AI, selecting the right ETF can make all the difference. Here are some of the top AI ETFs according to their average daily volumes:

- IYW – iShares U.S. Technology ETF

- BOTZ – Global X Robotics & Artificial Intelligence ETF

- AIQ – Global X Artificial Intelligence & Technology ETF

- IGM – iShares Expanded Tech Sector ETF

- FDN – First Trust Dow Jones Internet Index Fund

Want to learn more about them? Here are all the details you need to know about them

IYW – iShares U.S. Technology ETF

IYW, also known as the iShares U.S. Technology ETF, is an exchange-traded fund (ETF) designed to mirror the investment outcomes of an index comprising U.S. equities within the technology sector. Essentially, investing in IYW means investing in a collection of stocks from diverse U.S. technology firms.

As a non-diversified ETF, IYW concentrates its investments in a relatively limited number of companies. This aspect bears a certain level of risk, as the ETF’s performance becomes closely tied to the fortunes of these select few companies.

Don’t buy AI stocks without answering these questions

BOTZ – Global X Robotics & Artificial Intelligence ETF

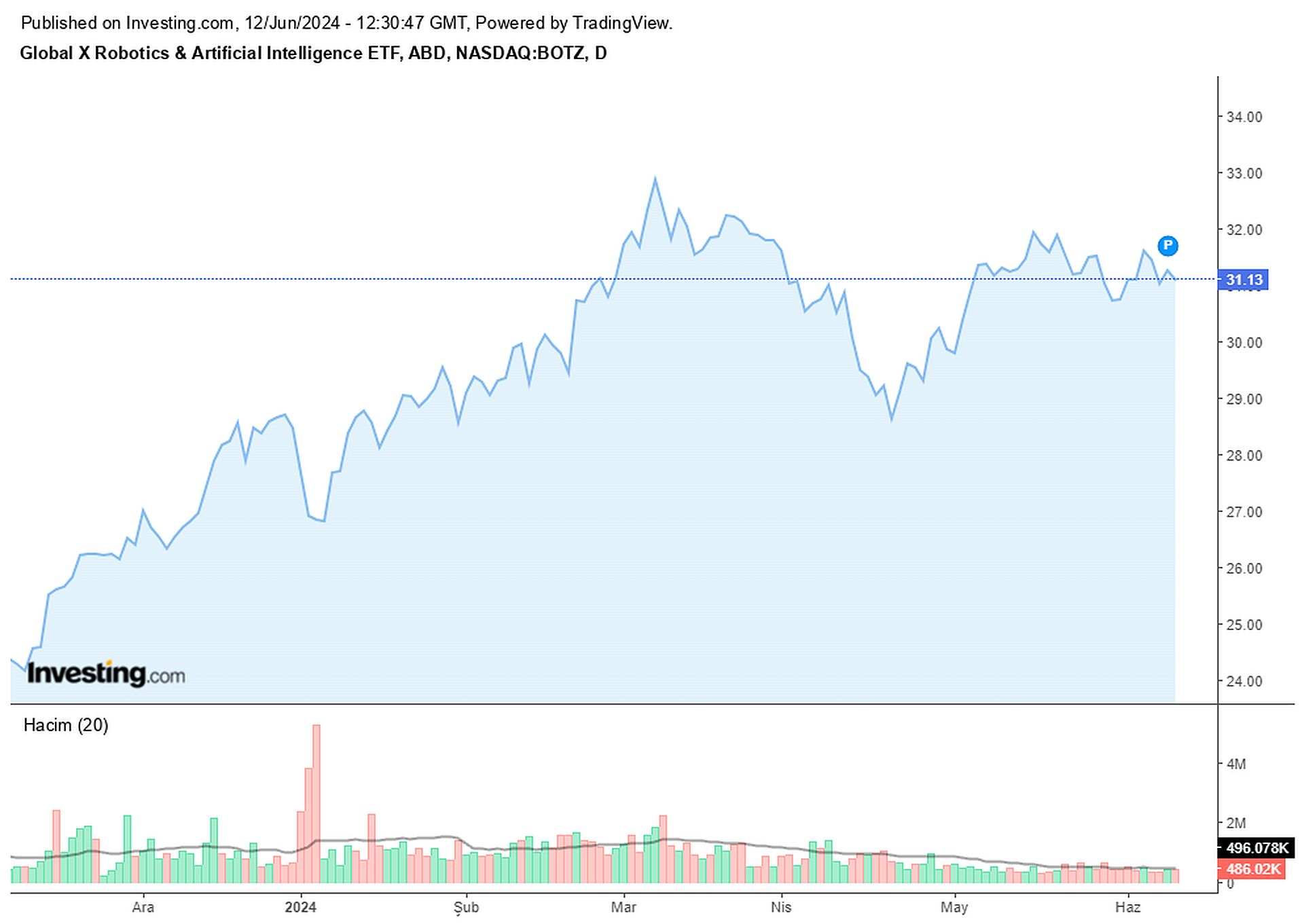

BOTZ, also known as the Global X Robotics & Artificial Intelligence ETF, offers investors an opportunity to tap into the potential growth of robotics and artificial intelligence (AI) through an exchange-traded fund (ETF) structure. The fund is strategically designed to mimic the price and yield performance of the Indxx Global Robotics & Artificial Intelligence Thematic Index. This index serves as a comprehensive benchmark, tracking companies engaged in various aspects of robotics and AI development.

With a focus on target industries such as industrial robotics and automation, non-industrial robots, and autonomous vehicles, BOTZ aims to capture the growth potential of these rapidly evolving sectors.

Investing in BOTZ essentially means gaining exposure to a diverse portfolio of stocks from companies across the globe that are regarded as leaders or potential leaders in the realms of robotics and AI. This approach allows investors to spread their investment risk while participating in the innovative and transformative advancements taking place in these industries.

AIQ – Global X Artificial Intelligence & Technology ETF

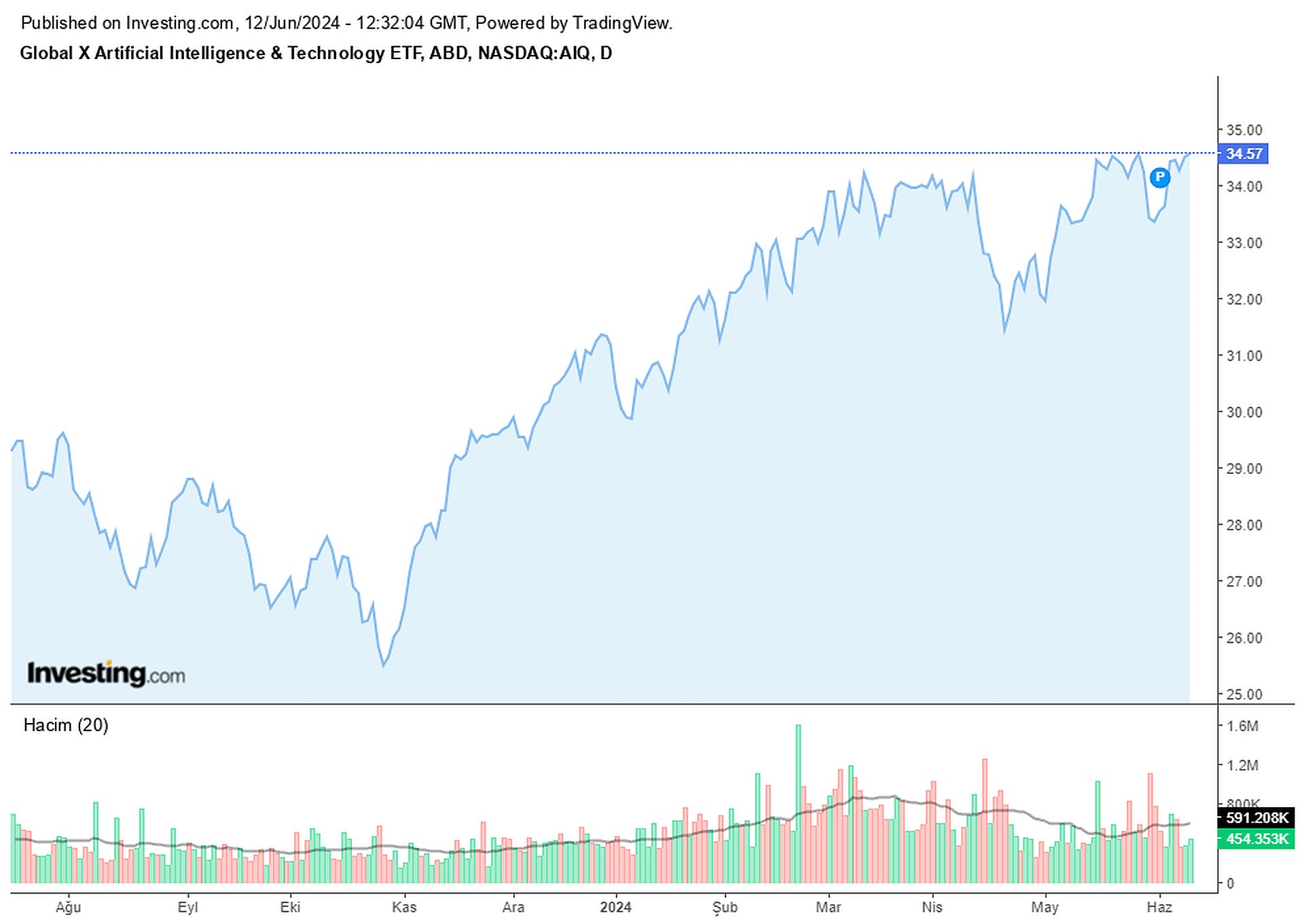

AIQ, the Global X Artificial Intelligence & Technology ETF, focuses on companies involved in artificial intelligence (AI) and big data. It aims to replicate the performance of the Indxx Artificial Intelligence & Big Data Index, which includes companies developing and utilizing AI, as well as those providing hardware for big data analysis using AI. AIQ is non-diversified, meaning it invests in a select group of companies, which can pose higher risks compared to broadly diversified ETFs.

While AIQ offers exposure to the potential growth of AI technology, investors should be mindful of the concentration risk inherent in its sector-specific approach.

What is happening in the AI crypto market?

IGM – iShares Expanded Tech Sector ETF

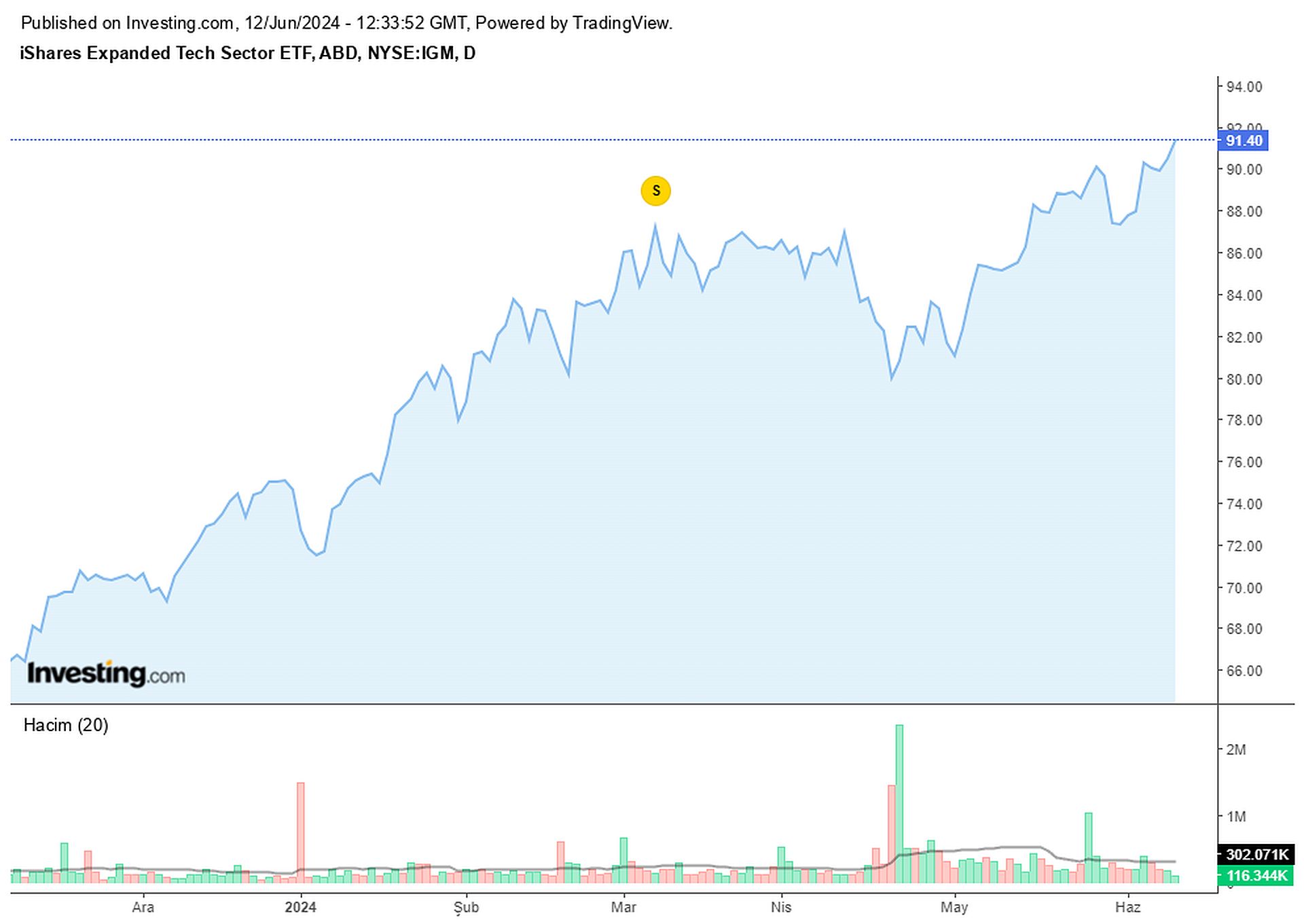

IGM, the iShares Expanded Tech Sector ETF, offers investors broader exposure to the technology sector compared to IYW. It tracks the S&P North American Expanded Technology Sector Index, which includes North American technology companies, along with some from the communication services and consumer discretionary sectors.

Its top holdings include major tech giants like Microsoft, Apple, and Nvidia, as well as Alphabet (Google) and Netflix.

Overall, IGM serves as a single ETF investment option for those looking to access a wider range of North American technology and technology-related companies.

FDN – First Trust Dow Jones Internet Index Fund

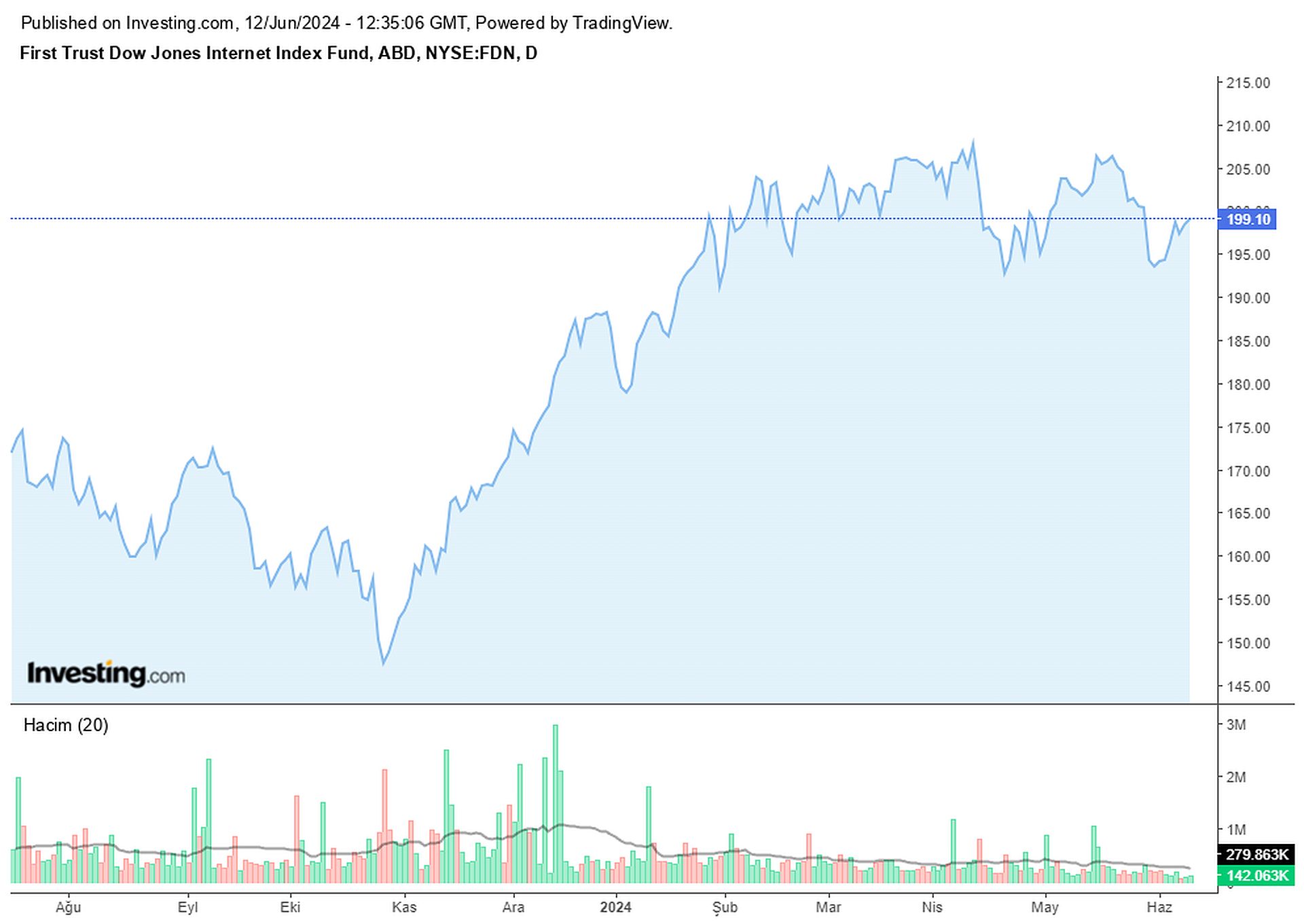

FDN, the First Trust Dow Jones Internet Index Fund, is an ETF that tracks the performance of the Dow Jones Internet Composite Index℠. This index comprises U.S. companies deriving at least 50% of their revenue from internet-related services. With an investment objective to replicate the price and yield of the index, FDN holds companies like Amazon and Meta Platforms within the internet sector.

Investing in FDN offers exposure to a diverse range of internet-based companies, potentially capitalizing on the industry’s growth. However, it’s important to note that FDN carries inherent risks, including sector concentration and associated fees.

Featured image credit: Eray Eliaçık/Bing