- Runa Capital’s ROSS Index highlights the growing market for AI and open-source technologies, tracking the rapid expansion of this sector. It reflects an increasingly vibrant ecosystem fueled by technological advancements.

- Standouts like LangChain and startups such as Reflex and AITable exemplify the sector’s innovation through significant funding and groundbreaking projects. These efforts showcase the diverse, evolving nature of AI and open-source ventures.

- The top 50 open-source startups, originating from 17 countries, show significant financial growth and community engagement. Funding soared to $513 million, a 32% year-on-year increase, spotlighting open-source innovation’s global influence.

A recent publication emphasizes the increasing demand for startups dedicated to developing open-source tools and technologies in the rapidly growing field of artificial intelligence. This trend is mirrored in the data infrastructure sector, which is experiencing a similar surge in interest.

Runa Capital, a venture capital firm that relocated from Silicon Valley to Luxembourg in 2022, has been issuing the Runa Open Source Startup (ROSS) Index over the last four years. This index highlights the most rapidly expanding commercial open-source software (COSS) startups. The firm releases updates every quarter and introduced its inaugural annual overview in 2022, offering a comprehensive analysis of the year’s activities.

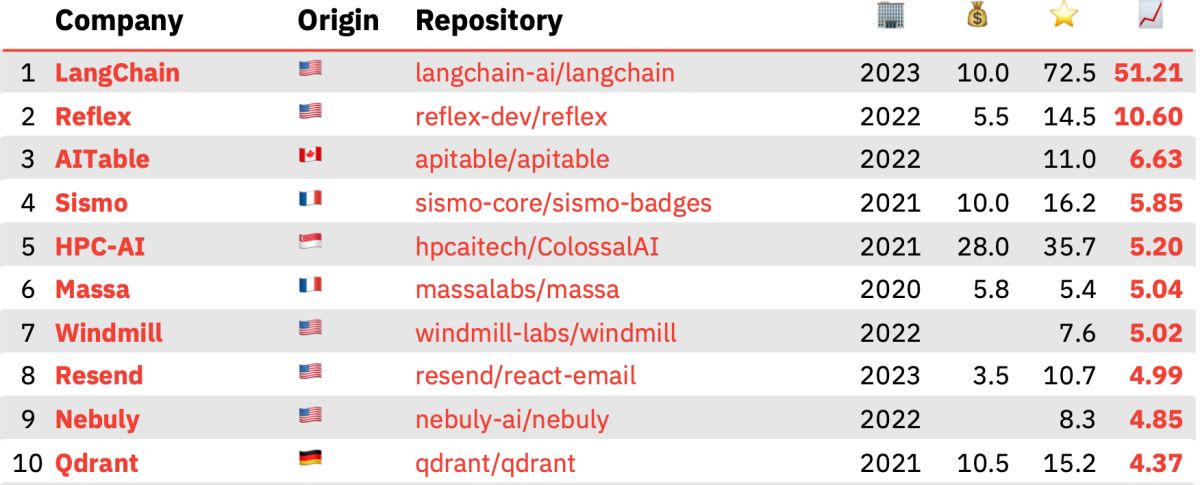

The hottest 10 COSS startups of 2023

Data’s critical role in artificial intelligence is underscored by AI’s dependence on vast datasets for learning and prediction, necessitating robust infrastructure for data collection, storage, and analysis. This convergence of trends is a key focus of the report.

LangChain, a startup from San Francisco that is just two years old, took the lead in the ROSS Index last year. It has created an open-source framework for developing applications using large language models (LLMs). In 2023, the flagship project of LangChain garnered over 72,500 stars, and recently, Sequoia spearheaded a $25 million Series A funding round for the company.

The top 10 also features Reflex, a framework for developing web applications in pure Python, which has just secured a $5 million seed funding. Also notable are Sismo, a privacy-centric service enabling users to share personal information with apps selectively; HPC-AI, aiming to establish a distributed platform for AI development and deployment akin to becoming the OpenAI of Southeast Asia; AITable, a platform for creating AI chatbots within spreadsheets, positioning itself as a rival to Airtable with an open-source twist; and Qdrant, an open-source vector database that recently raised $28 million to leverage the AI boom.

An expansive review of the top 50 trending open-source startups from the previous year revealed that over half are intertwined with AI and data infrastructure sectors.

About last year

Comparing the 2023 index with its predecessor poses challenges, primarily because companies frequently adjust their strategies or reposition their products to align with prevailing trends. The surge in ChatGPT’s popularity last year prompted many early-stage startups to shift their focus or enhance the “AI” aspects of their offerings.

Given generative AI’s landmark achievements last year, the surge in demand for open-source components is understandable, as businesses strive to compete with major proprietary AI entities like OpenAI, Microsoft, and Google.

Open-source software thrives on its global collaborative nature, with contributions from developers worldwide. This global collaboration reflects in the commercial open-source startups that often operate without a conventional physical headquarters.

The ROSS Index introduces a geographical dimension by noting that 26 of the listed companies are based in the U.S., although 10 of these originated in other countries and maintain a workforce or founders abroad.

The diversity extends further, with the top 50 companies originating from 17 different countries. Europe stands out with 23 incorporated entities, marking a 20% increase from the previous index. France leads in Europe with seven COSS startups, including two in the top 10, while the U.K.’s representation jumped from one to six startups, earning it the second spot in Europe.

Additional insights from the report highlight the diversity in programming languages used by the top 50 startups, expanding from 10 languages in 2022 to 12 last year. Despite this variety, Typescript remains the most favored, utilized by 38% of the companies. Python and Rust saw increased adoption, whereas Go and JavaScript experienced a decline.

The collective contributions to the top 50 ROSS Index startups rose by 12,000 in 2023, and their total GitHub stars surged by nearly half a million. Financially, the top 50 COSS startups saw funding reach $513 million last year, showing a 32% increase from 2022 and a significant 145% growth from 2021.

What role does artificial intelligence play in EdTech?

Determinants of top trending status

- Minimum of 1,000 GitHub stars required for consideration, ensuring a baseline level of popularity and community engagement.

- Emphasis on the annualized growth rate (AGR) of GitHub stars to measure how quickly a project is gaining attention, rather than just total star count, which favors projects that are growing rapidly in popularity over a specific period.

- Manual curation by the Runa investment team to identify projects from product-focused commercial organizations, aiming to spotlight open source startups rather than general projects.

- Startups must be founded within the last ten years and have received less than $100 million in funding, focusing on emerging rather than established companies.

- Assessment of how “open source” a startup is, considering the spectrum from fully open source to “open core” models, with a preference for startups that maintain a significant connection to their open-source repositories.

- Liberal interpretation of “open source,” including companies with “source available” licenses, such as those adopted by Elastic and MongoDB to protect against exploitation by major cloud providers, reflecting a commercial perspective of open-source rather than strict adherence to formal open-source licenses.

- Inclusion criteria consider the commercial impact and potential of open-source startups, excluding those primarily focused on professional services, side projects with limited support, or those lacking a commercial element.

- The ROSS Index serves as a complementary tool alongside other indexes like Two Sigma Ventures’ Open Source Index and GitHub’s trending repositories page, offering a unique focus on open-source startups specifically, rather than open-source projects in general.

Featured image credit: Kerem Gülen/Midjourney