Optimal resource allocation, risk mitigation, value creation, and strategic growth initiatives. These are just a few factors that underline the necessity of smart financing for an acquisition.

While you may be an expert in the field, you may lack the means to bring ideas to life. Therefore, we invite you to explore a data room, the solution that turns even complex processes into a breeze.

What is a virtual data room?

A virtual data room is a multifunctional solution designed for protecting and simplifying business transactions. The platform includes secure documentation storage, user management tools, activity tracking mechanisms, and collaboration features.

Most often, users employ the software for mergers and acquisitions, due diligence, initial public offering, and fundraising. Other cases include audits, corporate development, and strategic partnerships.

What is smart financing in the acquisition deal context, and how can data rooms support the process?

When you’re in the market for a new vehicle but have specific requirements and constraints, you need something that fits your budget and complies with preferences. To make a good choice, you employ smart financing principles similar to those used in an acquisition deal. Explore them now and see how a dataroom can help:

Tailored funding structure

Evaluate your budget, financial health, and priorities to determine how much you can afford to spend on a vehicle

Organizations should identify the most suitable capital structure for the deal. The choice usually depends on the acquisition size, the acquiring company’s financial health, and the desired level of control and ownership.

How virtual data rooms help

The software enables gathering and arranging financial documentation in a centralized space. With all these materials in one place, stakeholders can quickly access and review the necessary data to evaluate various financing options.

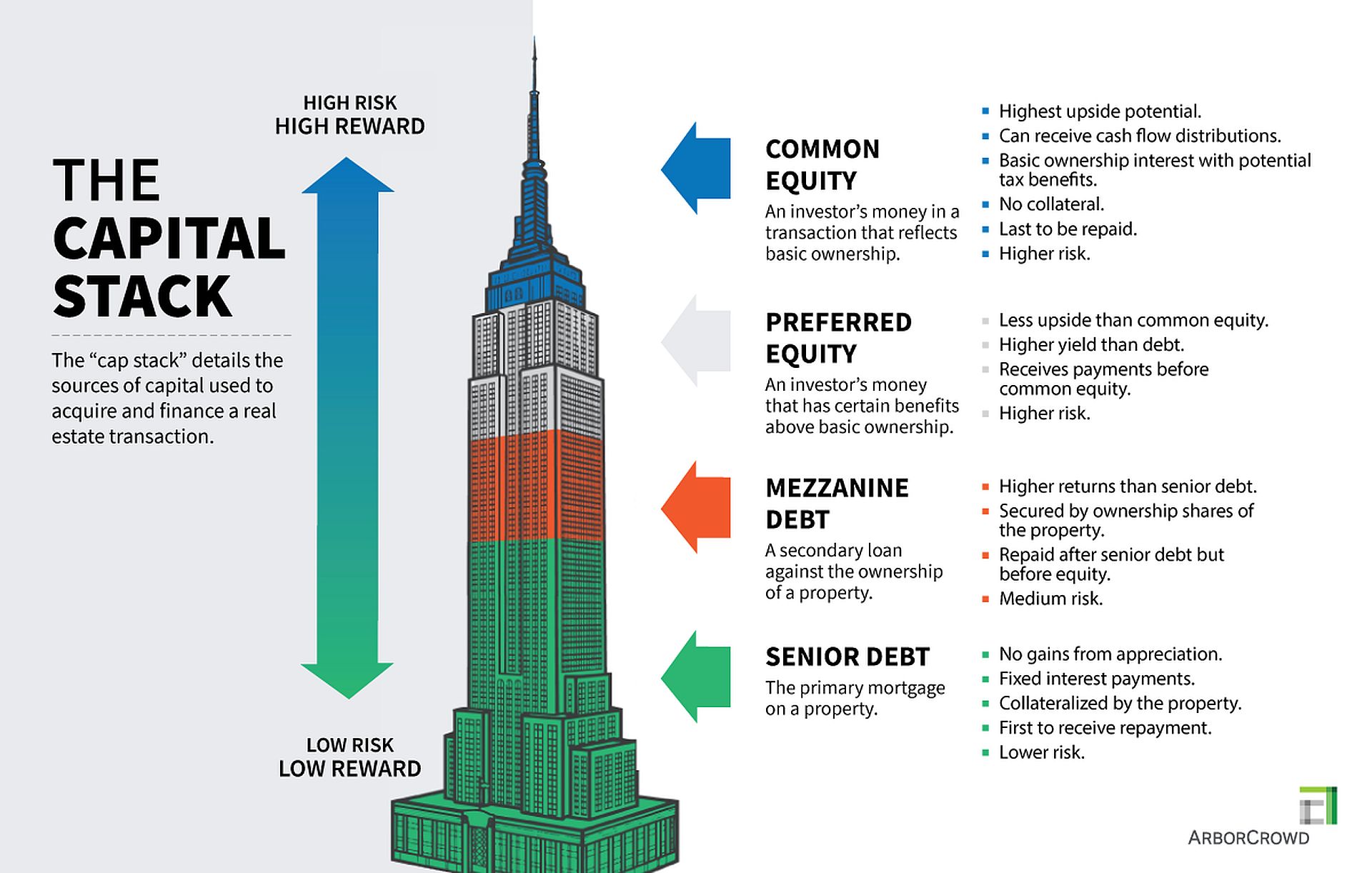

Optimized capital stack

Balance the features and parts of a vehicle to meet your needs while minimizing costs

Here, a target company balances debt and equity components to minimize the cost of capital. At the same time, it should maintain financial flexibility and mitigate risks. Some potential scenarios are structuring the transaction with a mix of senior or subordinated debt, or equity financing.

How virtual data rooms help

You get a secure way to share data with potential buyers and investors, which can facilitate discussions around optimizing the capital stack. Furthermore, a virtual data room provides a controlled and easy-to-use platform for due diligence.

Alternative financing solutions

Obtain funds to customize your vehicle with accessories and upgrades

In addition to traditional sources, smart financing explores alternative ones to fund acquisition without traditional debt or equity obligations.

For more insights: How to finance an acquisition?

How virtual data rooms help

Apart from the ability to explore alternative solutions on the platform and share insights with other parties, a data room offers various tools for discussions around innovative financing structures and partnerships without compromising confidentiality.

Creative deal structuring

Negotiate personalized modifications with a dealer to tailor the vehicle to your preferences

Organizations may face various challenges throughout the procedure. Therefore, they need to implement specific mechanisms to align the interests of buyers and sellers.

How virtual data rooms help

Stakeholders use the software to collaborate on developing and negotiating creative deal structures. With multiple task management and collaboration tools that data room providers offer, all parties can ensure they are on the same page.

Risk mitigation strategies

Conduct safety checks and test drives to ensure a smooth ride

Smart financing incorporates procedures to protect stakeholders from risks and ensure successful outcomes. In particular, it’s possible through conducting thorough due diligence, implementing legal and financial protections, and securing appropriate insurance coverage.

How virtual data rooms help

With virtual data room solutions, stakeholders can access the necessary documents to assess risks and negotiate favorable terms and conditions, such as hold harmless agreements, representations, and warranties.

Financial modeling and analysis

Simulate worst-case scenarios and determine whether you can still afford the car

You should assess the feasibility and impact of different financing scenarios on the acquisition deal. Common ways are conducting sensitivity analysis, stress testing, and scenario planning to evaluate the potential outcomes.

How virtual data rooms help

With the help of AI-powered analytics tools featured by a digital data room, you can evaluate different scenarios based on relevant documents.

By now, you clearly understand how the software can improve each step. If you are ready to integrate the solution, check out our short checklist with helpful tips and choose the best fit.

How to choose the best virtual data room provider for your acquisition?

Virtual data room providers may significantly vary in feature sets and security mechanisms. Therefore, you should carefully evaluate and compare products considering the following features:

Document security

- Real-time data backup

- Two-factor authentication

- Multi-layered data encryption

- Physical data protection

- Dynamic watermarking

Data management

- Bulk document upload

- Drag and drop file upload

- Multiple file format support

- Auto index numbering

- Full-text search

User management

- User group setup

- Bulk user invitation

- User info cards

- Granular user permissions

- Activity tracking

Collaboration

- Activity dashboards

- Private and group chats

- Q&A module

- Commenting

- Annotation

Ease of use

- Multilingual access

- Single sign-on

- Scroll-through document viewer

- Mobile apps

Integrate virtual data rooms and secure funds for your acquisition in a controlled and easy-to-use environment!

Featured image credit: Alina Grubnyak/Unsplash