TransUnion’s myTrueIdentity, a free identity protection service, has a lot to offer. Worried about your financial security in the digital age? Identity theft is a growing threat, but protecting yourself doesn’t have to break the bank.

2023 has already witnessed a staggering number of high-profile data breaches, exposing millions of individuals’ personal information to potential thieves. From healthcare providers like 23andMe to retailers like Comcast, no sector seems immune.

The cost of identity theft is staggering, reaching an estimated $8 billion in the United States alone in 2022. This includes everything from unauthorized credit card charges to fraudulent loans and even tax refund theft.

This grim reality underscores the urgent need for proactive measures to safeguard our identities. It’s no longer enough to simply be cautious; we need comprehensive protection like the one offered by TransUnion’s myTrueIdentity. But what is myTrueIdentity exactly? Let us explain.

What is myTrueIdentity?

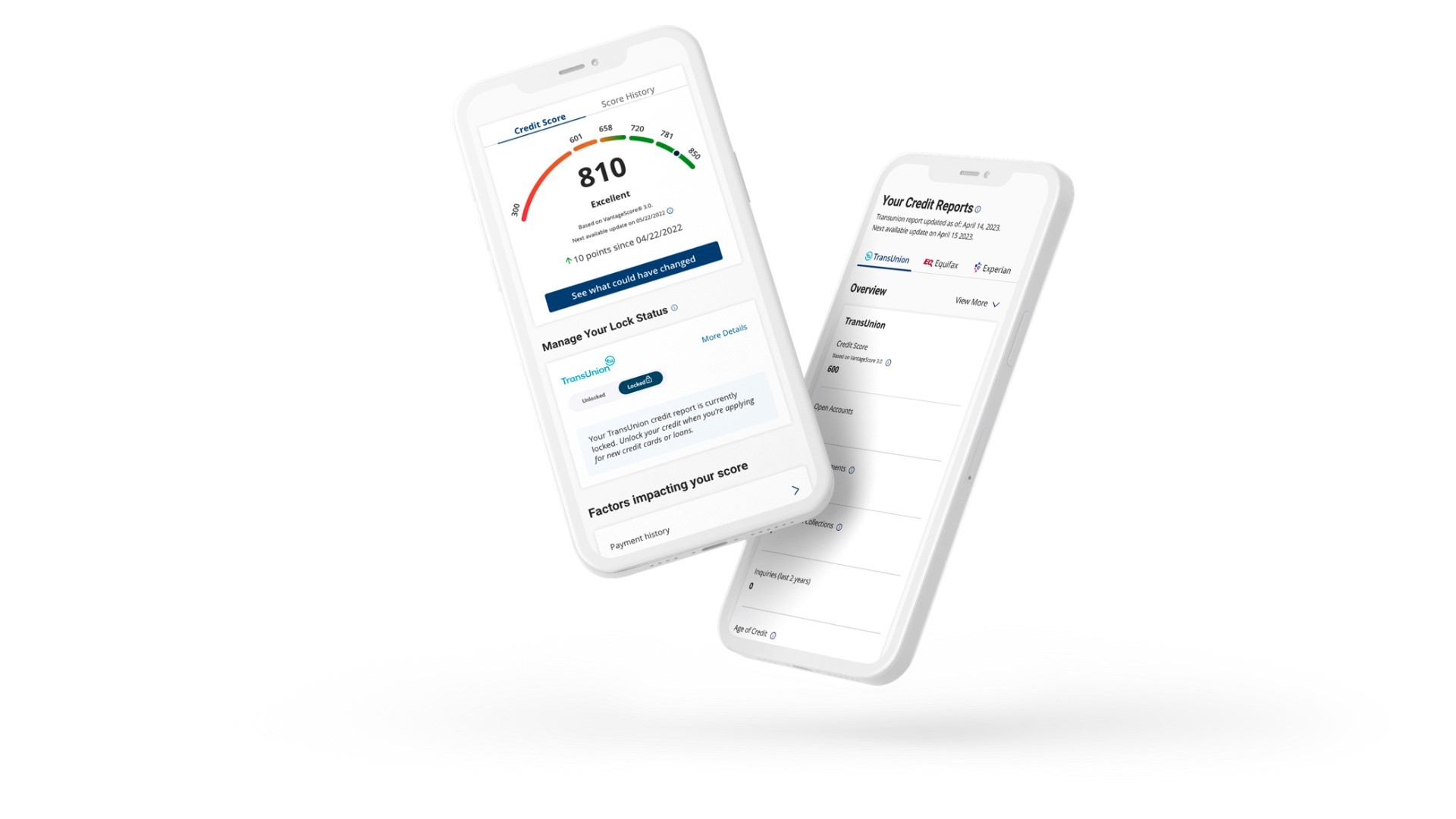

myTrueIdentity is a credit monitoring and identity protection service offered by TransUnion, one of the three major credit reporting agencies in the United States and Canada. It aims to safeguard your financial information from identity theft and help you understand and manage your credit health.

myTrueIdentity provides its customers the following services:

- Credit monitoring:

- Tracks changes to your credit report from TransUnion, like new accounts opened in your name or changes in existing accounts

- Alerts you to suspicious activity that could indicate identity theft

- Credit report access:

- Allows you to view your detailed credit report and TransUnion credit score as often as you want

- Helps you identify errors or outdated information that could be impacting your credit score

- Identity protection tools:

- Offers features like address monitoring, dark web scans, and social security number alerts to help detect potential identity theft early

- Some plans include recovery assistance from dedicated specialists in case you become a victim of identity theft

Are TransUnion and myTrueIdentity the same?

Not quite! While both are involved in managing your credit and protecting your identity, they play different roles.

TransUnion is one of the three major credit reporting agencies in the US and Canada. They collect and maintain information about your credit history, like loans, debts, and payment records. This information is used by lenders and other businesses to assess your creditworthiness.

TrueIdentity, on the other hand, is a brand name used by TransUnion for their credit monitoring and identity protection services. These services track your TransUnion credit report for changes, alert you to suspicious activity, and sometimes offer additional tools like dark web scans and recovery assistance.

So, think of TransUnion as the library housing your credit report, and TrueIdentity as the security guard monitoring it for suspicious activity. While they’re connected, they’re distinct entities within the financial ecosystem.

So, TransUnion is a credit reporting agency that collects and maintains information about your credit history, while TrueIdentity is a brand name used by TransUnion for their credit monitoring and identity protection services. Both play important roles in managing your credit and protecting your identity, but they are separate entities with different responsibilities.

Is myTrueIdentity legit?

Yes, myTrueIdentity is a legitimate service offered by a reputable company, TransUnion, a major credit reporting agency. TransUnion’s services are used by millions of consumers and businesses, and their credit monitoring and identity protection services are designed to help protect your credit and personal information.

However, it’s important to carefully review the terms and conditions of any credit monitoring service before signing up. Be sure to understand what features are included in the service, the cost, and how your data will be used.

myTrueIdentity offers a range of features to help protect your credit and identity, including credit monitoring, credit report access, and identity protection support. They also provide alerts to notify you of any changes made to your credit report, which could be a sign of identity theft.

How much does myTrueIdentity cost?

myTrueIdentity has no charges or subscription plans, therefore it is completely free! Users can experience unparalleled protection of:

- Standard 1-Touch Credit Lock

- Instant TransUnion Credit Alerts

- Identity Theft Insurance

- Identity Resolution Guidance

- Credit Report Access

- Unlimited TransUnion Report Refreshes

- TransUnion Credit Report Alerts

Remember, identity theft is not an abstract statistic; it can happen to anyone, anywhere. Don’t become a victim. Take action today and explore how myTrueIdentity can be your shield against this modern-day menace. Choose proactive protection and reclaim your peace of mind in the face of a looming reality.

Featured image credit: Girl with red hat/Unsplash.