In business and finance, technology continues to reshape how organizations operate. AI and ML manage to touch our business life with AP automation systems. This transformational tool has gained significant traction across industries, promising streamlined processes, enhanced accuracy, and unparalleled control over financial operations. But what exactly is AP automation, and why is it causing such a buzz in the corporate world?

Traditional AP methods often involved manual data entry, a painstaking process prone to errors. The laborious task of keying in data from invoices and documents not only consumed time but also led to inaccuracies that could have far-reaching consequences.

And also, the reliance on physical documents, such as invoices, purchase orders, and receipts, created mountains of paperwork. This not only demanded extensive storage space but also made document retrieval a cumbersome affair.

This is exactly where AP automation comes in. Let’s take a detailed look at this process that solves many complicated problems for your business in the background.

What is AP automation?

AP automation stands for Accounts Payable automation. It refers to the use of technology and software to automate tasks associated with accounts payable departments within organizations. The main goal of AP automation is to streamline and optimize the entire invoice-to-payment process, reducing manual effort, improving accuracy, and providing greater visibility and control over financial operations.

Businesses need AP automation for several reasons:

- Efficient invoice processing: Manual invoice processing can be time-consuming and error-prone, leading to missed deadlines, lost or misplaced invoices, and delayed payments. AP automation helps businesses streamline this process, ensuring that invoices are processed quickly and accurately, and that payments are made on time

- Improved cash flow management: With AP automation, businesses can better manage their cash flow by reducing the time it takes to process invoices and make payments. This allows them to take advantage of early payment discounts, avoid late fees, and maintain a healthy cash balance

- Enhanced visibility and control: AP automation provides real-time visibility into the invoice-to-payment process, enabling businesses to track the status of invoices, identify bottlenecks, and make informed decisions about their financial operations. This increased control also helps businesses detect and prevent fraudulent activity

- Reduced costs: By automating accounts payable processes, businesses can significantly reduce the cost of manual data entry, paper storage, and postage. According to a study by the Aberdeen Group, businesses can save up to $1.50 per invoice by automating their accounts payable processes

- Better vendor relationships: AP automation helps businesses maintain positive relationships with their vendors by ensuring timely payment and clear communication. This can lead to better pricing and terms, as well as improved collaboration on future projects

- Compliance and security: AP automation solutions often include security features such as data encryption, user authentication, and segregation of duties to protect sensitive financial information. Additionally, these solutions support compliance with industry standards like SOC 2 and SSAE 18, providing peace of mind for businesses concerned about regulatory requirements

- Scalability: As businesses grow, their accounts payable departments often struggle to keep up with the increased volume of invoices. AP automation scalably handles growing invoice volumes, making it an essential tool for businesses looking to expand their operations

Taking all these into account, AP automation is a critical tool for businesses looking to streamline their financial operations, improve cash flow management, enhance visibility and control, reduce costs, build stronger vendor relationships, ensure compliance and security, and scale their operations efficiently.

How does AP automation work?

The first step in AP automation is typically the capture of invoices from vendors. This can be done through electronic data interchange (EDI), email, or by scanning paper invoices. Once captured, the system extracts relevant information such as date, amount, and vendor name, and matches it against existing purchase orders and receipts. This helps ensure that the invoice is valid and accurate before it is processed further.

After the invoice has been captured, the system validates its accuracy and completeness by checking for missing or incorrect information. This may involve verifying purchase order numbers, item quantities, and prices. If there are any discrepancies, the system may alert the appropriate personnel for resolution. This helps prevent errors from occurring downstream in the process.

Once the invoice has been validated, it is routed through a predefined workflow for approval. This may involve multiple levels of approvers, such as managers, department heads, or accounting staff. The system may also provide notifications and reminders to ensure timely approval. This ensures that the invoice is properly authorized before it is processed further.

Upon approval, the system generates payment instructions to the bank or pays the vendor directly through a digital payment network. This eliminates the need for manual check writing, reduces the risk of lost or stolen checks, and ensures timely payment. The system also provides an audit trail of all transactions, which can be useful for future reference or auditing purposes.

It’s time to shelve unused data

Vendor management is another important aspect of AP automation. Many solutions include vendor management capabilities that enable organizations to maintain accurate and up-to-date records of their vendors. This includes tracking contact information, payment terms, and performance metrics. By having a centralized repository of vendor information, organizations can better manage their relationships with vendors and make informed decisions about future procurement.

Reporting and analytics are also key features of AP automation solutions. These tools provide insights into spending patterns, payment trends, and vendor performance. Organizations can use this data to identify areas for improvement, optimize their supply chain, and negotiate better pricing with vendors.

To ensure seamless communication between accounts payable and other departments, many AP automation solutions integrate with enterprise resource planning (ERP) systems. This enables real-time updates and synchronization of data between systems, reducing errors and improving efficiency.

Security and compliance are also critical considerations for AP automation solutions. These solutions must adhere to strict security standards and regulatory requirements, such as data encryption, user authentication, and segregation of duties. They should also support compliance with industry standards like SOC 2 and SSAE 18.

Finally, some advanced AP automation solutions leverage artificial intelligence (AI) and machine learning (ML) technologies to improve invoice processing accuracy, detect fraudulent activity, and predict future spend patterns. These technologies can help organizations further streamline their accounts payable processes and gain greater control over their financial operations.

Key features to look out for in AP automation software

Although AP automation may seem complicated, there are many software that do it. As we mentioned before, using AP automation software offers several benefits, including improved accuracy, reduced costs, increased visibility, and improved vendor relationships. By automating the AP process, businesses can save time and money, reduce errors, and make better financial decisions. We will give you some suggestions later in this article, but first, let’s talk a little bit about what you should pay attention to when choosing AP automation software.

Invoice capture and data extraction are essential features in AP automation software, allowing for the elimination of manual data entry and the automatic capture of invoices from various sources such as email, fax, mail, and EDI. This feature also extracts key data from invoices, including invoice number, vendor name, amount due, due date, and purchase order number.

Workflow automation and approval routing are also critical features in AP automation software. These features allow for the creation and automation of custom workflows for invoice approval, routing invoices to the appropriate approvers based on predefined rules. For instance, invoices can be routed to the department manager for approval if the amount is below a certain threshold, and to the CFO for approval if the amount is above a certain threshold. This helps speed up the approval process and reduces bottlenecks.

Vendor management and communication are additional important features in AP automation software. This feature provides a central repository for vendor information and allows for electronic communication with vendors. This can help improve vendor relationships and streamline the AP process. For example, vendors can be sent electronic purchase orders and invoices.

Integration with ERP systems is another significant feature of AP automation software. This integration enables the automation of the flow of data between the two systems, eliminating duplicate data entry and improving the efficiency of the AP process. For instance, AP automation software can be integrated with an ERP system to automate the process of paying invoices.

Reporting and analytics capabilities are also crucial features in AP automation software. They provide comprehensive reporting and analytics capabilities, giving visibility into AP performance and enabling informed financial decisions.

Examples of reports that can be generated include the average time it takes to process invoices, the number of invoices processed on time, and the amount saved by taking advantage of early payment discounts.

What are the best AP automation software of 2023?

There are several software solutions that offer various features to streamline accounts payable processes, enhance financial management, and improve efficiency for businesses.

As for the best AP automation software of 2023:

Tipalti

Tipalti is a financial technology company that specializes in finance automation solutions. The company’s main objective is to help businesses streamline their financial processes by eliminating manual and inefficient tasks. This allows companies to manage their finances more effectively and efficiently.

One of the key features offered by Tipalti is its mass payments solution. This feature enables businesses to pay global partners and suppliers in multiple countries and currencies. This is particularly useful for businesses with international operations, as it simplifies the process of managing payments across different regions.

Tipalti also specializes in payables automation, including accounts payable and payment management workflow. The company’s software helps businesses automate these processes, reducing manual efforts and increasing efficiency. By automating these processes, businesses can save time and resources, allowing them to focus on other critical areas of their operations.

While Tipalti has received generally positive reviews from customers, some users have reported issues or concerns related to the company’s services. These concerns are often raised through online complaints and reviews. However, it’s important to note that these issues are not necessarily representative of the entire customer base.

Sage Intacct

Sage Intacct is a cloud-based financial management software designed to help businesses streamline their accounting via AP automation, financial reporting, and management processes. This software offers several key features and benefits, making it a valuable tool for organizations looking to modernize their financial operations.

One of the main advantages of Sage Intacct is its cloud-based hosting, which allows for easy access and collaboration from anywhere with an internet connection. This means that team members can work together seamlessly, regardless of their location, and can access financial data and documents in real time.

In terms of financial management, Sage Intacct provides comprehensive solutions for accounts payable, accounts receivable, general ledger, and other critical financial functions. This enables businesses to consolidate their financial operations into a single platform, improving efficiency and accuracy.

Business intelligence is another key feature of Sage Intacct. The software offers robust tools for analyzing financial data, generating reports, and making data-driven decisions. This allows businesses to gain valuable insights into their financial performance, identify trends, and make informed decisions about future strategies.

Overall, Sage Intacct is widely used by businesses looking to enhance their financial management and streamline accounting processes. Its cloud-based hosting, comprehensive financial management solutions, business intelligence capabilities, compliance features, financial visibility, and improved efficiency make it a valuable tool for organizations seeking a modern, cloud-based solution for their financial needs.

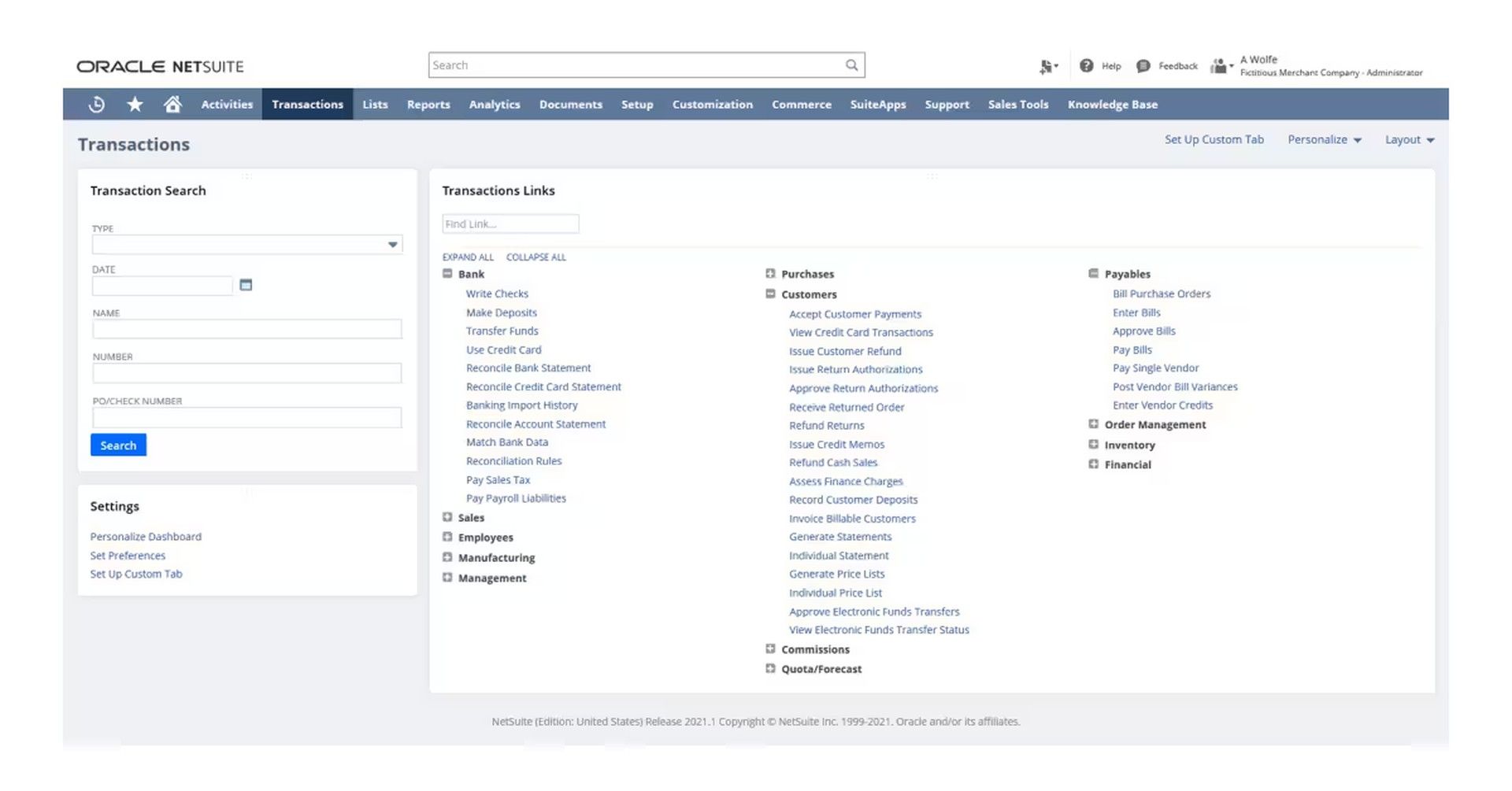

Oracle NetSuite

Oracle NetSuite is a leading integrated cloud business software suite that offers a wide range of capabilities to help businesses streamline their operations and improve efficiency. The software includes a comprehensive suite of tools for various business functions, including ERP (Enterprise Resource Planning), CRM (Customer Relationship Management), AP automation, and e-commerce.

This means that businesses can use NetSuite to manage multiple aspects of their operations, from financial management and accounting to customer relationship management and e-commerce.

One of the key benefits of using Oracle NetSuite is its ability to provide a holistic solution for organizations. By integrating various business functions into a single platform, NetSuite enables businesses to simplify their operations and improve communication between different departments. This can lead to increased productivity, reduced errors, and enhanced decision-making capabilities.

In addition to its comprehensive suite of tools, Oracle NetSuite has also made headlines due to its acquisition by Oracle Corporation in November 2016. The acquisition solidified Oracle’s position as a major player in the cloud business software market and further established NetSuite as a leading provider of cloud-based business solutions.

Users can access Oracle NetSuite through the login portal, which provides a centralized platform for various business-related activities. With over 35,000 NetSuite customers worldwide, the software has demonstrated its relevance and popularity in the market.

SAP Concur

SAP Concur is a leading brand specializing in integrated travel, expense, and invoice management solutions. One of the key benefits of using SAP Concur is its ability to automate accounts payable (AP) processes. By streamlining the process of managing invoices, expenses, and travel, SAP Concur helps businesses gain greater visibility and control over their financial operations.

At its core, SAP Concur simplifies the management of travel, expenses, and invoices for businesses, providing total visibility and control over these processes. The platform offers a comprehensive suite of solutions that connect all aspects of travel and expense management, making it easier for organizations and their employees to manage these processes.

One of the ways that SAP Concur simplifies AP processes is through its user-friendly design. The platform is designed to make expense reporting, travel booking, and invoice management more convenient for users. This means that employees can easily track and submit expenses, while finance teams can efficiently manage invoices and payments.

Another key feature of SAP Concur is its mobile app. The companion mobile app, available for Concur® Travel, Concur® Expense, and Concur® Invoice, enables users to manage these functions on the go. This means that employees can track expenses, book travel, and manage invoices from anywhere, at any time.

DocuWare

DocuWare is a cloud-based Software as a Service (SaaS) provider that specializes in document management, repository, and workflow automation. One of the key benefits of using DocuWare is its ability to automate accounts payable (AP) processes. By streamlining document management and workflows, DocuWare helps businesses gain greater efficiency and control over their financial operations.

DocuWare also offers solutions for digitizing and managing business documents, making them easily accessible when needed. This includes storing, organizing, and securing digital documents, which can help reduce manual tasks and improve productivity.

Another key feature of DocuWare is its workflow automation capabilities. The software helps automate document-related workflows within organizations, streamlining processes such as approvals, reviews, and document routing. This can help reduce manual tasks and improve efficiency, allowing employees to focus on higher-value tasks.

Data security is also a top priority for DocuWare. The platform places a strong emphasis on protecting sensitive documents and ensuring compliance with regulations. It provides central archiving functions to safeguard data and documents, giving businesses peace of mind knowing that their financial information is secure.

As businesses continue to adapt and evolve in the ever-changing landscape of finance and technology, AP automation is undeniably a cornerstone for modernization, efficiency, and financial success. It’s a tool that empowers organizations to not only streamline their financial operations but also to make informed, data-driven decisions, setting them on a path to sustainable growth and success in the digital age.

Featured image credit: Freepik.