- The United States now offers a complete tax credit of $7,500 for those purchasing a Tesla Model 3.

- Recent updates to the eligibility criteria, stemming from the Inflation Reduction Act regulations, require electric vehicles to have batteries with at least 50% domestic content or source 40% of essential minerals from US or free trade partners (excluding China) to qualify for the full tax credit.

- Some EVs initially lost eligibility but were later reinstated, while the maximum tax deduction for a Tesla Model 3 with rear-wheel drive and long range has been reduced to $3,750 to comply with the revised rules.

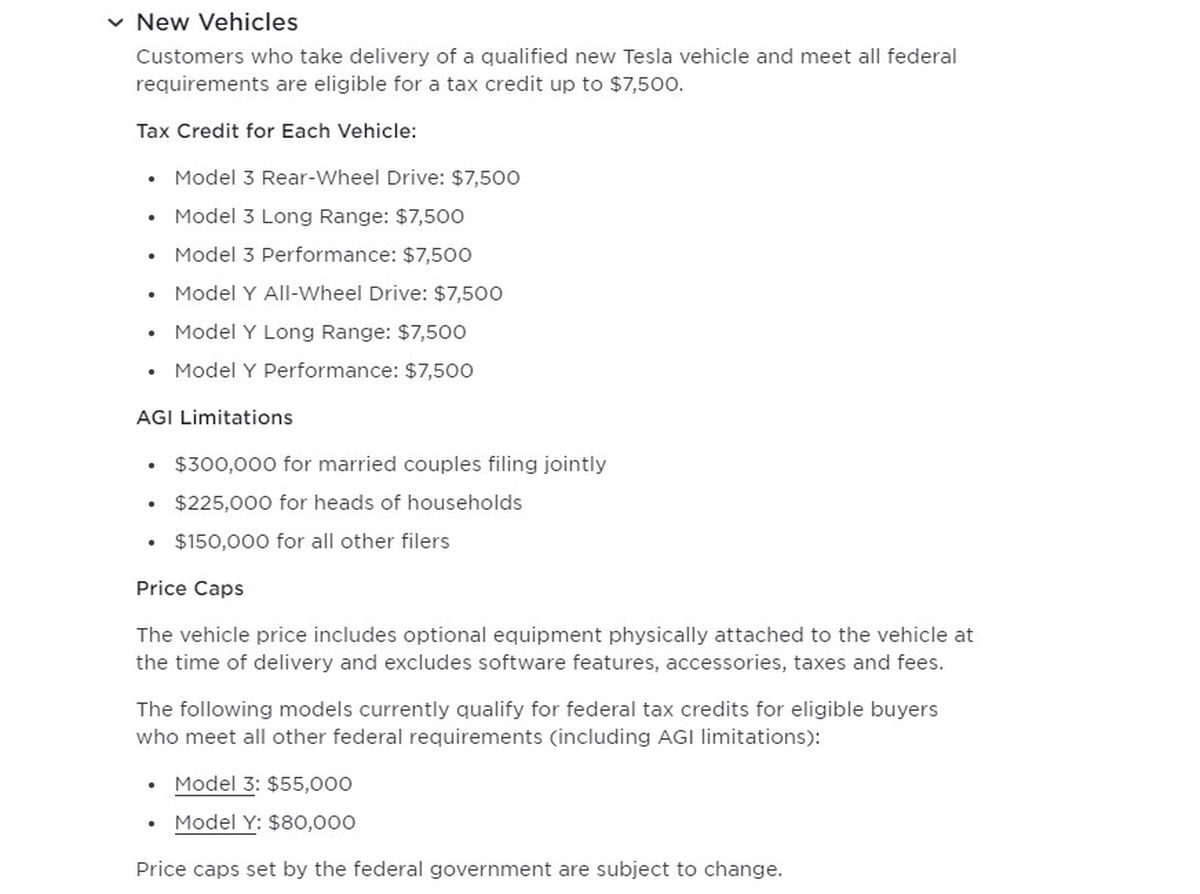

In the United States, people who decide to purchase a Tesla Model 3 can now become eligible for the complete tax credit amount of $7,500. Notably, Tesla’s website has undergone modifications to explicitly highlight that the rear-wheel drive Model 3, along with its long-range and performance iterations, now meet the requirements for receiving the full federal tax credit dedicated to electric vehicles. Additionally, if you have an inclination towards the all-wheel drive, long-range, or performance Model Y, you will also have the opportunity to capitalize on comparable savings.

Price limits for Tesla Model 3 tax credit

In adherence to the Inflation Reduction Act regulations, which were enacted by the president in the previous year, the US government recently unveiled updated criteria determining eligibility for the federal EV tax credit of $7,500. Effective from April 18th, the new requirements state that electric vehicles qualify for a $3,750 tax credit if their batteries are constructed or assembled in the United States, comprising a minimum of 50% domestic content.

However, if the manufacturer sources at least 40% of the essential minerals used in the batteries from either the US or its free trade partners (excluding China), they become eligible for the full $7,500 credit. These revised regulations aim to promote the domestic production of electric vehicles and incentivize the procurement of essential minerals from trusted trade partners.

Following the implementation of the revised regulations, a number of electric vehicles were initially disqualified from the list of eligible vehicles for tax credits. However, in the subsequent days, certain EVs were reinstated after meeting the updated criteria. As a result of these adjustments, the maximum tax deduction for a Tesla Model 3 equipped with rear-wheel drive and a long range has been reduced to $3,750, aligning with the new requirements.

To comply with the revised rules, Tesla may have undertaken measures such as modifying the batteries in their new Model 3 deliveries or sourcing from alternative suppliers. These actions ensure that the vehicles meet the stipulated criteria set forth by the regulations.

It’s worth noting that the actual cost of a Tesla Model 3, taking into account the tax credit, may vary depending on local incentives for electric vehicles. In certain regions, prospective buyers may have the opportunity to acquire the base model for just over $30,000, thanks to the combined benefits of the tax credit and other local incentives designed to promote the adoption of EVs.

The tax credit of $7,500 is subject to specific eligibility criteria and is not accessible to all buyers. To qualify for the credit, purchasers must meet a defined income threshold, and the price of Teslas must not exceed a predetermined limit; otherwise, they will be ineligible for the tax credit.

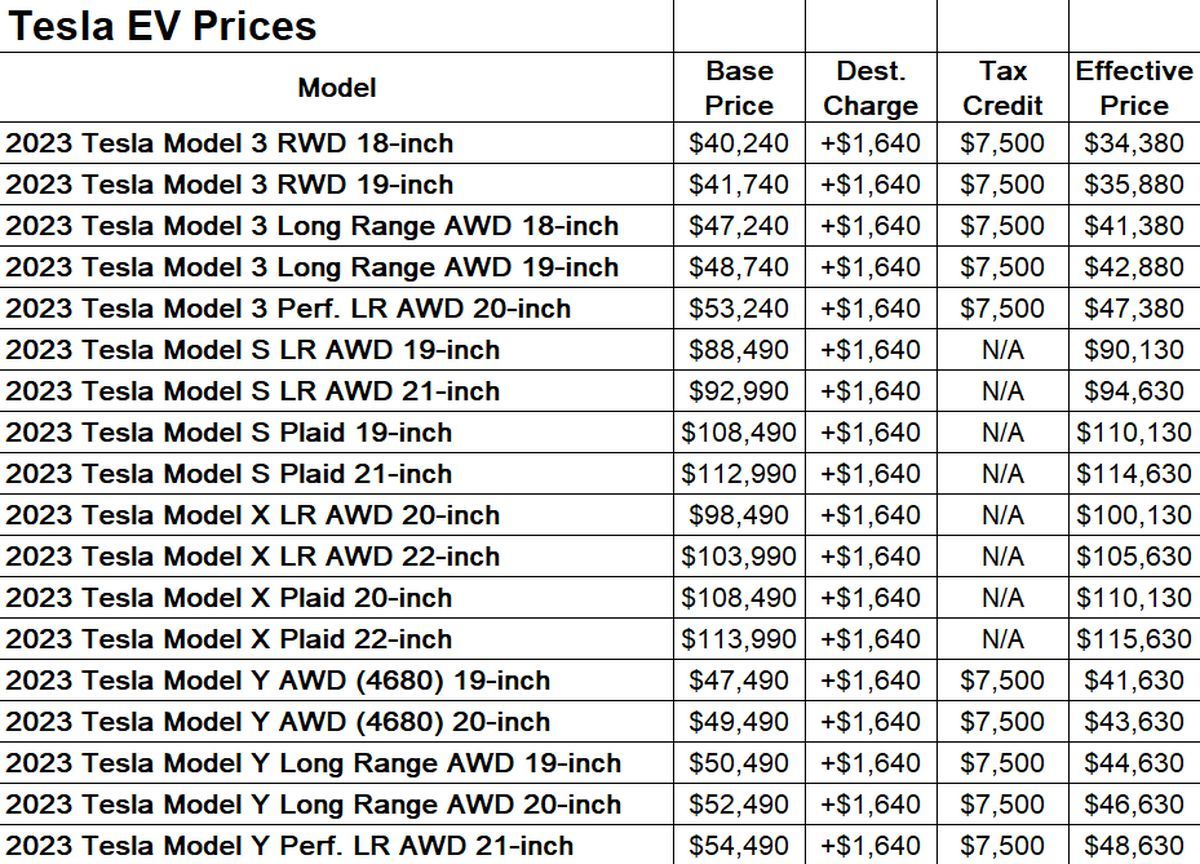

How much will I pay for a new Tesla 3 after the tax credit?

- Below, you will find a comprehensive price comparison of various Tesla models, highlighting their respective costs after factoring in the tax credit:

If you are enthusiastic about electric vehicles, we invite you to delve into our article exploring aluminum-sulfur batteries, offering an in-depth exploration of the latest advancements in battery technologies.