Viraj Soni didn’t choose fraud prevention as a career—it chose him.

His mission began long before he had the title of fraud strategy manager, back when he was a child sitting beside his parents in police stations and courtrooms. His father had just been defrauded of nearly all his life savings. The family was left reeling—not just from the financial devastation, but from the crushing reality that justice and recovery were slow, uncertain, and often out of reach.

“We spent years chasing leads, sitting with lawyers, filing police reports,” remembers Soni. “And in the end, we recovered only a fraction of what was lost. It felt like watching your future being taken away in slow motion.”

That experience—marked by frustration, confusion, and helplessness—became a defining part of Soni’s upbringing. The psychological toll of watching his father’s financial legacy unravel shaped his understanding of the real cost of fraud: not just the monetary loss, but the erosion of safety, stability, and trust.

From victim to vanguard

Fast forward to today, and Soni leads a team of fraud strategy experts working with U.S. financial institutions to prevent the very kind of losses his family once suffered. His current role focuses on proactively identifying and intercepting fraud threats before they reach consumers. But for Soni, it’s more than work—it’s redemption.

“Every time we prevent a fraudulent transaction or stop an account takeover, I think of families like mine. I think of my younger self. And I know we just saved someone from years of pain.”

At the core of Soni’s approach is a belief in preemptive defense. His team leverages a combination of advanced behavioral analytics, real-time monitoring, and machine learning-assisted fraud detection systems to identify suspicious activities across millions of transactions.

They build custom dashboards using tools like Tableau and Power BI to visualize trends and isolate outliers. Their fraud decisioning systems incorporate hundreds of variables—from login metadata to merchant-level chargeback data—and flag anything out of place before it becomes a loss.

But the impact doesn’t stop at the system level.

Protecting people, not just portfolios

“Fraud is deeply personal. Behind every flagged transaction is a real person. And if we’re not humanizing our work, we’re not doing it right,” Soni explains.

To that end, his team works hand-in-hand with customer experience operations to build automated yet compassionate alert flows—messaging customers in real time when their accounts may be compromised. They also collaborate with internal fraud recovery and legal teams to maximize dispute recovery and minimize the chance of recurring victimization.

In parallel, Soni champions education. He has launched fraud awareness initiatives aimed at empowering consumers with practical knowledge about phishing, smishing, synthetic identity fraud, and emerging scams targeting the elderly and digitally vulnerable.

“People don’t need to be security experts. But they do need to understand that one bad click or a misplaced credential can change their lives. And they need to know someone’s got their back.”

A modern battlefield

Fraud today is not what it was when Soni’s family was targeted. It is faster, more scalable, and more invisible. With the rise of card-not-present (CNP) transactions, synthetic identities, and dark web marketplaces selling everything from social security numbers to biometric spoof kits, fraud has become an arms race between financial institutions and globally distributed criminal networks.

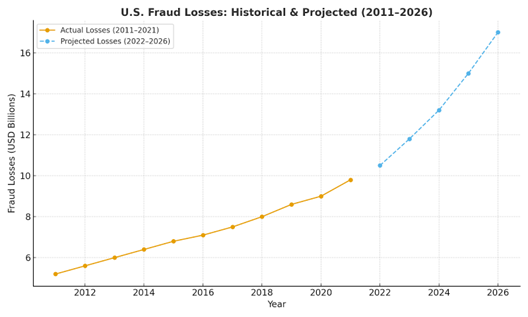

According to the FBI’s Internet Crime Report, identity theft and cybercrime alone cost Americans around $6.9 billion in 2021. The Federal Trade Commission reported receiving over 2.8 million fraud complaints in 2021 with customers reporting about $5.9 Billion lost to scams, a 30% increase year over year. Major consulting firms and FTC expect scams, and digital fraud could push U.S. fraud losses into the tens of billions annually by the late 2020s.

Soni’s role places him directly at the frontline.

“In the U.S., we’re now seeing digital fraud outpace traditional fraud across most verticals. It’s no longer about one-off hackers—it’s organized crime, it’s bots, it’s social engineering campaigns operating at scale.”

Soni’s response? Precision and scalability.

He’s built fraud strategies that dynamically adjust thresholds based on velocity patterns, customer tenure, historical risk scores, and even merchant behavior. His strategies integrate machine learning-based rulesets and human-in-the-loop adjudication—ensuring that no alert is ignored, but also that good customers aren’t burdened with unnecessary friction.

He’s also known for pushing innovation across his partner institutions. One initiative involved modernizing an outdated fraud rules engine to adopt a new gradient-boosted decision tree model, resulting in a 45% increase in fraud capture while maintaining approval rates.

In another project, his monitoring revealed a previously undetected account takeover trend affecting low-dollar essential transactions—grocery and restaurant purchases. Soni’s team traced the activity, implemented additional PII-verification on digital enrollment flows, and stopped what would have escalated into over $4 million in losses in a single month.

“What people don’t realize is—when a fraudster takes over an account, it’s not just about that card. They get access to everything: names, addresses, history, patterns. That data gets reused, recycled, and weaponized. We’re fighting to stop that cycle.”

The road ahead

Despite the sophistication of fraudsters, Soni remains optimistic.

He envisions a future where fraud prevention is seamlessly embedded into every digital experience—where data, intelligence, and empathy work together to protect customers silently in the background. He’s currently exploring advancements in behavioral biometrics, device fingerprinting, and explainable ML/AI to ensure fraud defenses remain ahead of evolving threats.

But Soni is quick to point out that technology alone won’t win the battle. “Fraudsters don’t operate in silos, so neither can we,” he says. He believes the next frontier lies in collaboration—banks, regulators, fintechs, and consumers working together. Industry intelligence-sharing, standardized fraud data exchanges, and public–private partnerships will be essential to outpace organized crime networks that often operate with military-level coordination.

The stakes are clear. According to a McKinsey study, global fraud losses are projected to exceed $40 billion annually by 2030, with the U.S. accounting for nearly half due to its heavy reliance on card-not-present (CNP) transactions. The FTC has already reported a 30% year-over-year rise in digital scams, and Juniper Research warns that synthetic identity fraud alone could cause $8 billion in losses by 2027.

In response, Soni imagines a customer experience that is both frictionless and secure: “The best fraud prevention is invisible. Customers shouldn’t have to feel the defenses around them—just the confidence that someone’s got their back.” He points to innovations such as zero-friction authentication, personalized fraud alerts, and real-time consumer education nudges as the direction leading banks must take.

On the regulatory front, Soni foresees rising scrutiny. With fraud losses spiraling into the tens of billions, U.S. institutions could face stricter oversight, higher penalties, and mandatory adoption of advanced fraud monitoring frameworks. “The banks that lead on this now will not only avoid fines—they’ll set the benchmark for trust,” he says.

Looking further ahead, he sees fraud prevention as part of a larger societal safety net, strengthened by technologies like quantum-resistant encryption, decentralized identity frameworks, and AI-driven real-time threat intelligence. But the mission, for him, always circles back to people.

“At the end of the day, fraud isn’t about algorithms or data points—it’s about lives disrupted and futures at risk,” he reflects. “I couldn’t protect my dad back then. But today, I get to protect millions. And that makes every fight worth it.”

Before concluding our interview with Viraj, we jumped into a rapid-fire Q&A:

What’s one fraud trend that keeps you up at night?

Viraj Soni: Real-time payment fraud. With instant transfers like Zelle and RTP, money is gone in seconds. Recovery rates are often under 15%. Once it’s out, it’s almost impossible to claw back.

How is AI changing the fraud landscape—for better and worse?

Viraj Soni: It’s a double-edged sword. Fraudsters are generating phishing emails that are grammatically perfect and creating synthetic identities at scale. But on the defense side, machine learning helps us detect patterns humans would miss. The key is explainability—if we can’t explain why a model flags something, regulators and customers won’t trust it.

What’s the most underestimated fraud vector right now?

Viraj Soni: Account opening fraud in digital lending and BNPL (Buy Now Pay Later). Thin-file customers are vulnerable, and fraudsters exploit gaps in credit bureau data. Losses here have grown double digits year over year.

How global are today’s fraud threats?

Viraj Soni: Extremely. A scam targeting a consumer in Dallas might be run by a fraud ring in Lagos, using servers in Eastern Europe, and cash-out mules in Asia. It’s a borderless crime economy.

Regulators are tightening the screws—what do you expect next?

Viraj Soni: I think we’ll see mandates for stronger identity verification and liability shifting in real-time payments. Similar to Europe, the U.S. is heading toward stricter authentication requirements. It’s going to reshape how banks think about onboarding and approvals.

Fraudsters are often described as “organized crime.” How accurate is that?

Viraj Soni: Very accurate. They run like startups—R&D, operations, customer service for their scams, even money-back guarantees to buyers of stolen data on the dark web. It’s industrialized crime, not just a lone hacker in a hoodie.

What’s a misconception people have about fraud prevention?

Viraj Soni: That it’s about saying “no.” It’s really about saying “yes” safely. Our job is to maximize approvals while minimizing losses. If you stop fraud but frustrate customers, you’ve failed.

What role does education play in prevention?

Viraj Soni: A massive one. Over 2.4 million Americans reported fraud in 2021, but many more never did because they were embarrassed or didn’t recognize it. Normalizing conversations about scams is just as important as building detection systems.

If you had unlimited resources, what’s the first thing you’d build?

Viraj Soni: A national fraud intelligence grid—real-time data sharing across banks, fintechs, regulators, and law enforcement. Fraudsters share information faster than we do, and that has to change.

Finally, what’s your personal mantra in this fight?

Viraj Soni: Protect one, protect many. Every blocked fraud attempt isn’t just a number—it’s someone’s livelihood, their rent, their savings. That perspective keeps me grounded.

Viraj turned childhood loss into a lifelong mission. In doing so, he reminds us that the true victory in fraud prevention is measured not in dollars saved, but in trust restored.