No longer considered the “future of work,” AI is infiltrating industries and job roles at impactful rates.

Across the U.S. economy, one-third of the U.S. workers are interacting with some form of AI in their jobs today – even if many of these interactions are still in a limited capacity. And although much attention is directed toward industries that are easy to visualize (think driverless cars or robots on factory floors), the data indicates that the financial services industry may see the greatest change.

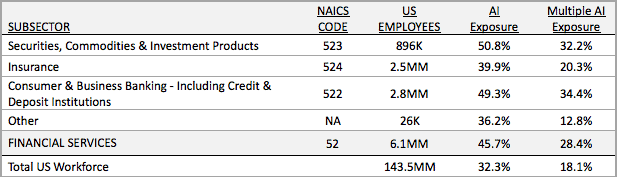

Financial services is already an advanced adopter of AI; it ranks third behind only the information industry – which includes the software subsector – and the manufacturing industry in terms of the percentage of workers exposed to AI, and it dwarfs U.S. averages in both breadth and depth of AI adoption. (See the table below for AI exposure rates.)

In the coming 12 months the financial services industry will outpace average U.S. investment in AI by more than 50%; the securities, commodities & investments subsector will invest at twice the average. But the rate of investment is not the only thing that makes the financial services industry unique when it comes to AI.

Portion of U.S Financial Services Workers Using or Exposed to AI by Subsector, 2018

n = 673

Financial services

An “AI Preparedness Survey” explored this difference by asking workers about very specific tasks they performed in their jobs. The data showed that a greater percentage of fi-serv employees’ weekly work hours could be eliminated via automation (15.0%) than of those for workers in the manufacturing industry (12.0%) or in the professional services industry (12.6%).

Financial services workers are seeing these effects through the deployment of specific technologies. For example, in the consumer & business banking subsector, the deployment of voice recognition technology to automate facets of customer interaction nearly doubles the deployment of that technology in U.S. industry at large. Not surprisingly, the data shows an even greater deployment disparity for programmatic trading tools in the securities, commodities & investments subsector. Injecting automation into customer service tasks and transaction processing may be seen as essential progress that frees up valuable human capital to perform more complex tasks, but it should be noted that the financial services industry’s deployment of scenario-planning AI – i.e., “thinking software” – is also quite accelerated (more than 10% of fi-serv firms will deploy scenario planning tools this year, versus only 5.9% of U.S. firms in general).

Source: Optimized Workforce, 2018

What does all this mean from a talent strategy perspective? The financial services workforce – and the tasks the people in it perform – are likely to experience more change than in other sectors of the U.S. economy. Financial services leaders will need to perform very granular task-based audits and skills assessments to understand and redefine their company’s talent needs. And workers in the industry should be aware that the talent pool the financial services industry will need following these audits may get smaller.

When these changes will take place is hard to say. Nearly 20% of financial services employees today report spending so much time on tasks AI could automate that they are missing key business goals – an indication that in today’s economy, the demand for financial services labor is still quite strong (a finding also supported by the current unemployment rate). The timeframe is also dependent on when fi-serv leadership begins reassessing their workforce in earnest.

Note: The article content is inspired by a recent report by Optimized Workforce.