According to Shikhar Ghosh, a senior lecturer at Harvard Business School, almost three-quarters of US venture-backed firms fail to return on investor’s capital. This week’s disheartening announcement from Fab proved that even the most promising cash cow is not a safe bet. Luckily, researchers at MIT may have come up with a mathematical model which can assess the “quality” of a startup- and help us understand why some startups go up in flames.

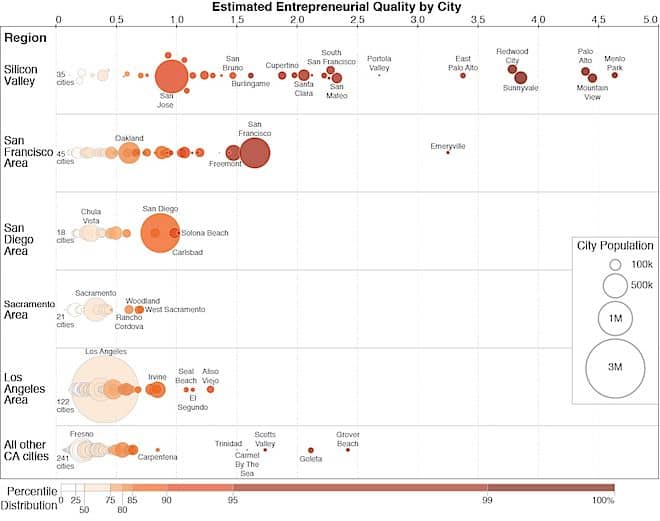

The model is based on an empirical study which projects the growth potential of tech startups with “new precision — and could help local or regional policymakers assess their growth prospects,” according to the MIT News Office. It determines the “quality” of startups, where “quality” denotes the chances of either landing an IPO or getting acquired within the first six-years.

“A central question in evaluating the impact of policies toward business creation, startups, and innovation, is simply how to measure the kinds of entrepreneurs who are likely to build growth businesses,” explains Scott Stern, the David Sarnoff Professor of Management at the MIT Sloan School of Management, the research lead.

The study summarized in Science, titled “Where is Silicon Valley?” explains how Stern and his colleague Jorge Guzman, a doctoral candidate at MIT Sloan, armed with an exhaustive list of new firms from California’s official business registry for the years 2001 to 2011, tracked a series of features that was common high-growth firms over the period from 2001 to 2006, for 70 percent of the firms.

With the results they tested their model with the outcomes of the other 30 percent of new firms in the same period. They also tested their model against new firms registered in the years 2007 to 2011.

“It is very difficult to manage the entrepreneurial ecosystem if we cannot measure the entrepreneurial ecosystem,” Stern said. “While our work is a first step, we believe that policymakers and practitioners and researchers would benefit from being able to assess … the combined entrepreneurial quantity and quality in a given region. What we want is to really create new real-time economic statistics.”

Some interesting findings from their research include:

- Companies without the name of the founder in the title had 70 percent more chances of either landing an IPO or getting acquired within the first six-years.

- Companies with shorter names had 50 percent more chances of success than the ones with longer names.

- Equally interesting is the fact that those companies with “high tech” names have 92% better chance of either landing an IPO or getting acquired.

The study also provides insight regarding geographies and locations.