The first half of 2025 marked a grim record for digital asset crime. With over $2.17 billion stolen from crypto services, losses have already surpassed the total for all of 2024.

The driving force behind this escalation is artificial intelligence, now a common attack tool. Criminals now have an arsenal of deepfake videos, advanced phishing campaigns, and automated agents. This new reality poses a fundamental security problem for the whole crypto world because the old reactive tools, audits and blacklists, just can’t keep up.

AI crypto attacks on the rise

What’s driving this surge? Simple economics. AI just makes crypto scams more lucrative. Generative AI tools helped push 2024 scam revenues to $9.9 billion, a trend that shows no signs of slowing. The methods are also becoming more advanced. Deepfake losses provide a stark example, with estimates projecting a rise from $12.3 billion in 2023 to $40 billion by 2027. It’s a technology that allows criminals to impersonate public figures so well that their scams appear legitimate, deceiving even careful investors.

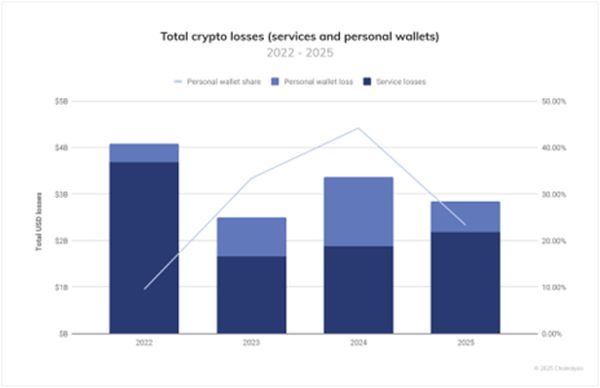

This trend is also marked by a diversification of targets. Attackers are moving beyond protocols to focus on individuals, with personal wallet compromises now accounting for 23.35% of all stolen fund cases in 2025. Individual users are often perceived as softer targets, lacking the robust security infrastructure of a large exchange.

The core problem is not just the volume of attacks, but the speed and personalization of deception. AI allows criminals to replicate trusted individuals or environments almost instantly, rendering conventional user wisdom, like “verify addresses carefully,” less effective when attacks appear to originate from trusted sources.

Why post-mortems and audits are no longer enough

The crypto industry’s established security toolkit is ill-suited for this new reality. Code audits are designed to find technical weaknesses, not to counter behavioral deception. Post-mortems are, by definition, reactionary, analyzing damage after it has already occurred.

Blacklists are easily circumvented as attackers can generate new wallet addresses instantaneously. These tools fail to address the fundamental nature of AI-driven fraud which exploits human trust and institutional processes rather than just code vulnerabilities.

This weakness is compounded by a core feature of cryptocurrency, finality. In traditional finance, suspicious transactions can often be flagged and reversed. In crypto, a signed transaction is irreversible. This immutability, a key strength of the technology, becomes its Achilles’ heel when fraud is automated by AI and executed in seconds.

The industry must therefore move from a defensive posture to a proactive design, embedding protection directly into transaction logic itself. This means developing wallets that detect anomalies in real time, require extra confirmations for unusual behavior, or analyze transaction intent before execution. This calls for new, verifiable standards for responsible AI development, and the onus is on the industry’s biggest players to lead in building trust and upholding the highest standards.

Binance Chief Security Officer Jimmy Su addressed this directly: “At Binance, securing ISO/IEC 42001 certification marks a pivotal milestone in our unwavering commitment to pioneering secure and responsible AI. As the world’s first global standard for AI management systems, it validates our rigorous frameworks for ethical development, bias detection, transparency, and full compliance with the EU AI Act—safeguarding users and ecosystems alike. This achievement isn’t just a badge of excellence; it’s a testament to our proactive stance against evolving AI risks, ensuring every innovation is built on trust and accountability. I’m immensely proud of our global teams whose expertise and collaboration made this possible. Looking ahead, Binance will continue leading the charge in trustworthy AI, empowering the crypto industry to thrive securely in an AI-driven future.”

A resilient crypto future

The security playbook has been rewritten by AI. Reactive measures are now obsolete. The crypto industry faces a clear decision, rely on temporary fixes or invest in genuine, foundational resilience. To do that, intelligent defenses must be built directly into the system, in real time. Wallets, signing processes, and transaction verification layers must become active participants in risk detection, not passive tools awaiting user commands.

The next frontier for crypto innovation is not just speed or yield, but fraud resilience. The industry must build systems that make AI-powered deception unprofitable and unviable by design. The goal is not merely to stop individual hacks but to restore confidence by making irreversible loss exceedingly rare. This is a necessary step for securing the mainstream trust and adoption upon which the future of digital assets depends.