Major tech companies are in a heated race to develop artificial intelligence (AI). This translates to vast sums of money being poured into research, development, and infrastructure. While the potential of AI is undeniable, many companies have yet to see significant returns on their investments.

This raises the question: Are these investments a sound business decision, or a gamble on the future?

The long road to AI payoff

Developing truly transformative AI applications is a complex and time-consuming endeavor. Technological hurdles need to be overcome, and robust safety and ethical considerations need to be addressed.

This reality stands in contrast to the hype that often surrounds AI. Investors and the public alike are sometimes led to believe that AI breakthroughs are imminent and will revolutionize industries overnight. The reality is that substantial financial investment must be coupled with a long-term vision and patient execution.

And CEOs of Big Tech companies are aware of this.

The return of Meta AI

Meta has been particularly vocal about its commitment to AI. The company established Meta AI, a dedicated research lab focused on developing foundational AI technologies. Meta AI’s goals are ambitious, aiming to create new hardware and software tools that will power the “metaverse,” a virtual world where users can interact with each other and digital objects in a hyper-realistic way.

This vision requires significant advancements in AI, particularly in areas like computer vision, natural language processing, and embodied AI. Meta has invested heavily in recruiting top AI talent and acquiring cutting-edge startups. However, building the metaverse is a long-term project. It’s unclear when, or even if, Meta will see a tangible return on this particular investment.

Initially, Meta’s approach to the metaverse might have been seen as overly ambitious. However, the company seems to be adapting its strategy. Recognizing the importance of accessibility, Meta AI has finally shifted its focus.

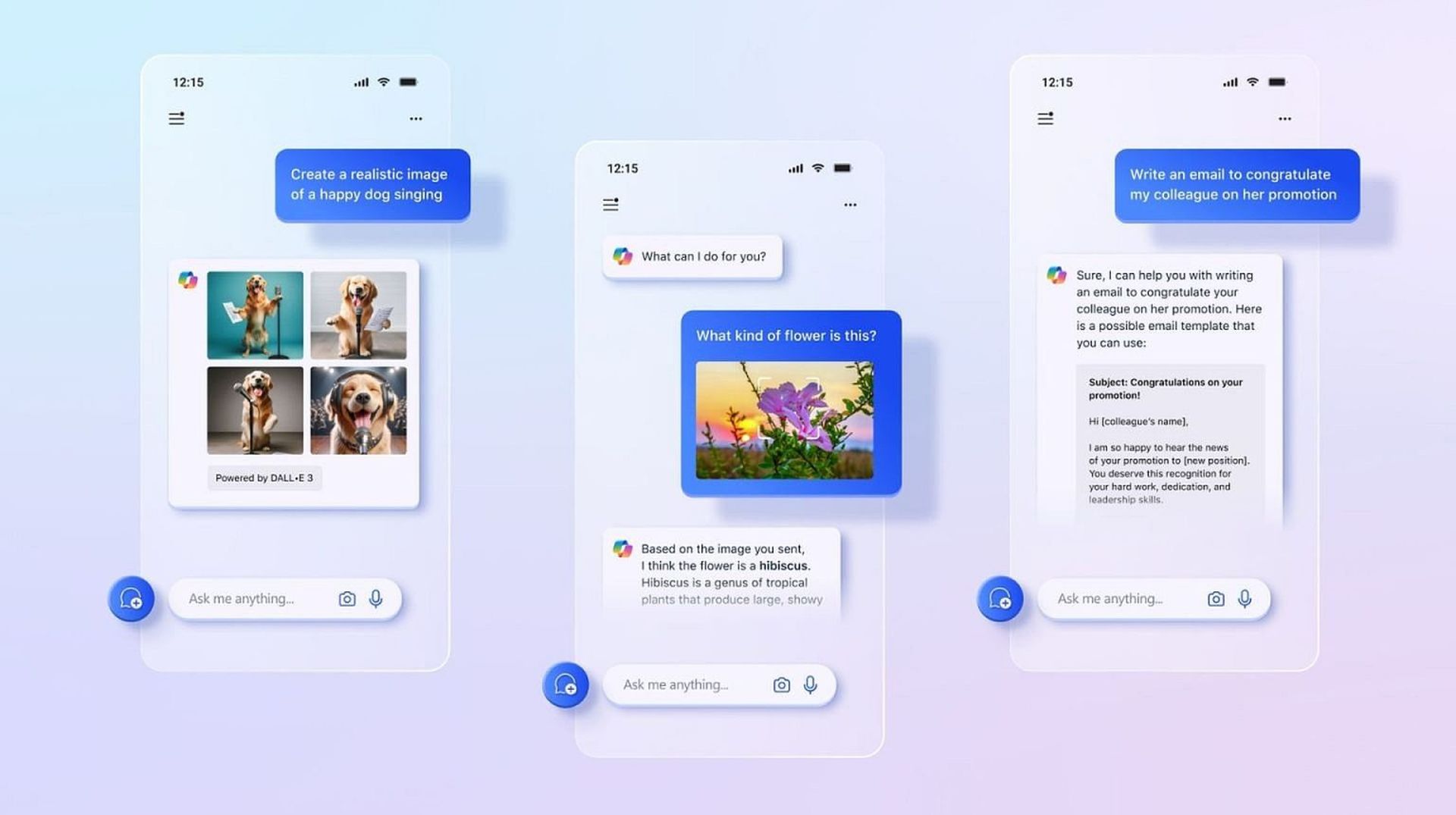

By integrating the Llama-3 LLM with popular social media applications like Facebook, Instagram, WhatsApp, and Messenger, with the new and updated version of Meta AI chatbot, the company is creating a more familiar entry point for users.

Microsoft has failed a gamble but stayed strong

Microsoft has made significant investments in developing custom AI chips. These specialized processors are designed to excel at specific AI tasks, offering significant performance improvements over traditional CPUs. Microsoft’s strategy was to gain a competitive edge by offering these chips not only in its own products like Azure cloud services, but also to other companies.

However, the AI chip market is rapidly evolving. While Microsoft initially aimed to compete with companies like Nvidia, the market leader, Nvidia has continued to innovate and improve its own AI chip offerings. This has made it difficult for Microsoft to gain traction, raising questions about the viability of its custom chip strategy.

Facing this challenge, Microsoft made a strategic shift. On the same day that the long-awaited Kartar chip was delivered to CEO Satya Nadella, and coincidentally the day that OpenAI CEO Sam Altman departed, Microsoft made a significant decision. The company placed the OpenAI team, in which it had already invested, in charge of leading the development of its artificial intelligence products.

Nowadays, while almost all CEOs declared they haven’t yet seen significant profits from AI, the news of Microsoft’s strategic shift with OpenAI resulted in a 5.5% increase in the company’s stock price. This suggests that investors see promise in Microsoft’s new approach, utilizing the expertise of a leading AI research lab and their investments in Copilot.

Elon Musk doubles down on AI

Elon Musk, a constant name in the tech headlines, continues his push into artificial intelligence (AI) with a significant investment in xAI, a company poised to become a direct competitor to OpenAI.

xAI is on the cusp of receiving a massive $6 billion funding boost, which could significantly elevate its position within the AI landscape. This influx of capital has the potential to fuel groundbreaking advancements in the field. Reports suggest that a $6 billion funding deal is nearing completion, valuing xAI at a staggering $18 billion.

Musk’s involvement with xAI, given his role as a founding member of OpenAI, has ignited a competitive rivalry between the two startups. However, xAI’s ability to secure such a substantial investment underscores a growing investor confidence in the AI sector. This development positions xAI as a serious threat to OpenAI, promising significant strides in AI technology.

Meanwhile, Grok-1.5V, xAI’s current AI language model, is already demonstrating capabilities exceeding those of ChatGPT and other similar models. Its performance in coding and math tasks is particularly impressive.

However, OpenAI shouldn’t be underestimated. They possess a significant head start, having been established within the AI space for a considerable amount of time. Despite his founding role at OpenAI, Musk’s xAI emerges as a formidable competitor. Let’s see if open-sourcing Grok is enough to do that.

This week, @xAI will open source Grok

— Elon Musk (@elonmusk) March 11, 2024

Gemini is a powerhouse potential with unproven profitability

While other companies focus on specific applications, Google is taking a broader approach with its AI initiative, Gemini. This powerful AI model is designed to be adaptable and handle a wide range of tasks, from writing and learning to summarizing information and generating images. Google has made Gemini readily available through its Bard app and integrated it with various Google products.

Despite its capabilities, Google has openly acknowledged that Gemini is not yet generating a profit, or losing $70B after a series of events, especially after people started to call Gemini AI ‘woke’. This is a stark contrast to the hype that often surrounds AI, where immediate financial returns are sometimes expected. Google’s transparency highlights the reality that substantial financial investment must be coupled with a long-term vision and patient execution for AI to reach its full potential.

Is it a symbiotic ecosystem or cutthroat competition?

The intense competition between major tech companies in the AI space raises questions about the future landscape. Will it become a zero-sum game where only one victor emerges, or will a more collaborative approach prevail?

There are signs that point towards both possibilities.

On one hand, companies like Meta and xAI are clearly positioning themselves as direct competitors vying for market dominance. Their aggressive investments and focus on achieving breakthroughs first suggest a cutthroat race to the finish line.

On the other hand, there are examples of collaboration within the AI community. Google’s and xAI’s open-sourcing of certain AI tools and frameworks allows other companies to build upon them. Additionally, research partnerships between universities and tech companies are fostering knowledge exchange and accelerating progress.

The future of AI will likely be shaped by a combination of both competition and collaboration. Companies may compete for specific applications, while simultaneously collaborating on foundational research to advance the field as a whole. This symbiotic ecosystem could ultimately lead to faster innovation and more widespread benefits from AI technology.

Featured image credit: vwalakte/Freepik