The Bitcoin halving 2024 expected to spark a prolonged bull market. The year 2024 is anticipated to be pivotal for cryptocurrency trading, with major events like the introduction of crypto exchange-traded funds (ETFs). Currently, investors hold their crypto assets. It is forecasted to double as Bitcoin prices are projected to reach unprecedented highs post-halving in April, and as Ethereum ETFs are poised for imminent approval.

When do we expect the Bitcoin halving 2024?

The Bitcoin halving is a quadrennial occurrence that slashes the quantity of new coins awarded to miners for adding a transaction group, or block, to the Bitcoin blockchain in half. This event plays a crucial role in diminishing the supply of the cryptocurrency, thereby enhancing its value.

Historical precedents suggest that Bitcoin halvings often align with significant external circumstances. The 2012 halving occurred amidst a European economic downturn and debt crisis, while the 2016 event happened alongside a surge in Initial Coin Offerings, which helped to buoy prices. Similarly, the 2020 halving saw a price increase as the onset of COVID-19 prompted concerns over inflation due to expansive monetary policies.

Looking towards 2024, several factors are aligning that could bolster Bitcoin’s value in anticipation of the Bitcoin halving 2024 scheduled for April, and potentially thereafter. Key among these is a demand surge from institutional investors purchasing Bitcoin for ETFs, a notable increase in on-chain activity observed in February, and enhanced incentives for miners.

Data from Bloomberg reveals that inflows into U.S. ETFs have escalated to $9 billion since their inception in January, with institutions amassing around 19,200 BTC in recent weeks, including a significant acquisition of half a billion dollars worth of BTC on February 9, 2024. This heightened investor interest leads to the creation of additional ETF shares, necessitating further BTC acquisitions.

The upcoming halving in April 2024 will see mining rewards halve from 6.25 BTC to 3.125 BTC per block, effectively reducing the supply of new currency by half. Across the four previous halving cycles, Bitcoin prices have consistently surged, in some cases increasing sixfold, highlighting the significant impact of these events on the cryptocurrency’s market value.

Google Bitcoin ETF ads are back again

The forthcoming Bitcoin halving 2024 in April will lead to a decrease in the number of bitcoins dispensed for each block mined, a strategy that inherently protects the asset’s value. However, this also implies diminished revenue for miners from the coins they mine. To navigate these challenges, miners are adopting various strategies, including liquidating part of their bitcoin reserves and vying for a larger share of Bitcoin transaction fees.

In the previous year, the introduction of Bitcoin Ordinals, which allows the embedding of digital files into Bitcoin units known as Satoshis, provided a new revenue stream for miners amid increasing network difficulty. Since their inception, Ordinals transactions have at times accounted for more than 20% of miners’ income.

This innovation saw a significant spike in transaction fees earned by miners, jumping from $5.17 on December 12, 2023, to a three-month high of $24.96 within four days, a rise that coincided with OKX’s announcement of a new Carnival inscription service on December 14, 2023.

Furthermore, Ordinals have spurred an uptick in on-chain activities, with developers initiating new projects. An analysis of on-chain data showed a robust increase in the number of active addresses, reaching 891,692 by February 11, 2024. Grayscale has forecasted that this expansion of the ecosystem is likely to continue, predicting that future developer engagement will further elevate Bitcoin transaction fees and solidify its market presence.

The anticipation surrounding the Bitcoin halving 2024 has already begun to manifest, with Bitcoin prices reaching unprecedented highs. The year 2024 presents a prime opportunity for newcomers to invest in cryptocurrencies, as 2025 is projected to be an exceptionally rewarding year, following the pattern of significant price increases observed after previous halvings.

The halving process is a key aspect of Bitcoin’s design to counter inflation. It methodically decreases the number of new bitcoins entering circulation, which can lead to supply constraints. When this scarcity factor merges with ongoing enhancements in the market, such as the approval of ETFs and the introduction of new financial products, it has the capacity to boost demand significantly. This dynamic is likely to have a notable effect on the cryptocurrency markets, driving up prices.

In a landmark decision in January, the US Securities and Exchange Commission approved 11 spot ETFs, ending nearly a decade of application rejections. These ETFs have collectively surpassed $10 billion in assets under management, and since their approval, the value of Bitcoin has increased by 12%. The market now anticipates similar endorsements for Ethereum and other digital currencies, suggesting a continued bullish outlook for the crypto sector in the wake of the Bitcoin halving event.

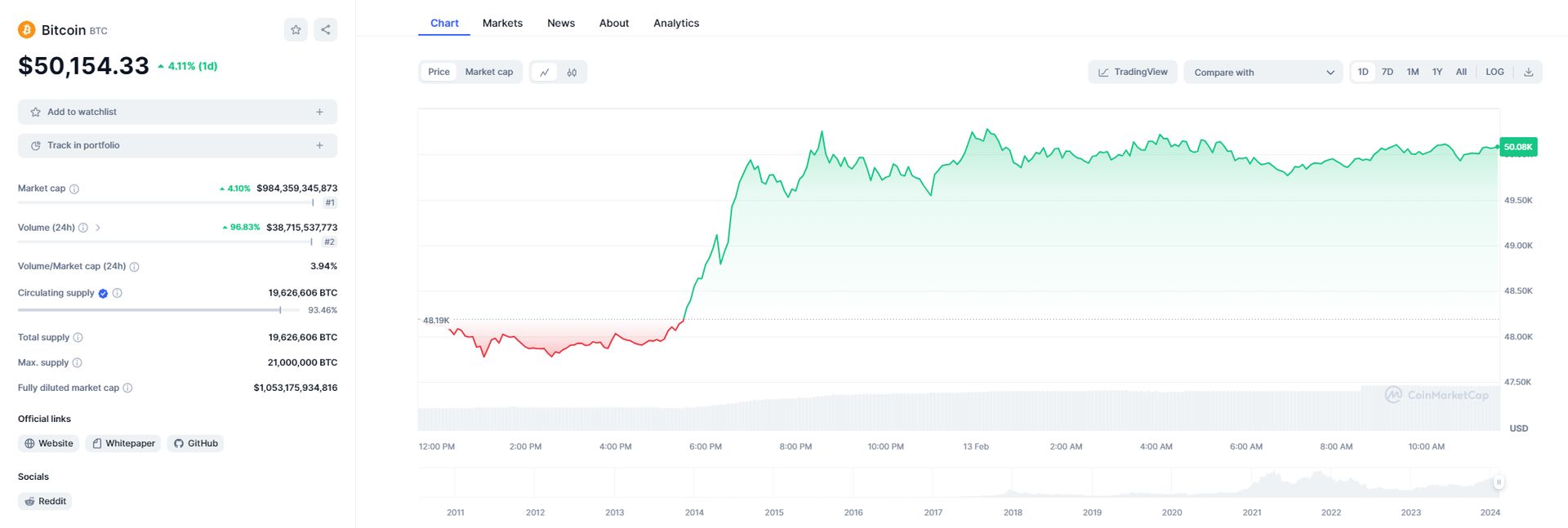

Bitcoin price

As per the latest figures provided by CoinMarketCap, a leading cryptocurrency tracking website, the trading value of a single Bitcoin has reached the substantial figure of $50,154, showcasing the current market dynamics and investor sentiment towards this dominant digital currency.

Featured image credit: Thought Catalog/Unsplash