At some point, almost every company faces questions like

- How good are the customers that we acquire?

- How do they differ from each other?

- How much can we spend to encourage their first or next transaction?

As a measure that determines the amount of profit a customer brings over the “lifetime” of engagement with the business, the customer lifetime value provides valuable insights on all of these questions.

When we analyze how generated contribution margin is distributed among the customer base, in most cases, there is a very small group of customers who are responsible for most of it. Sometimes it´s 1% of the customers generating over 10% of contribution margin. Imagine, if we knew how to acquire only those customers? Only 10% of our customer base would be needed to generate the same amount of contribution margin.

Knowing which customers to acquire and keep, and more importantly at which costs, grants a company a sufficient competitive advantage.

This means that CLV is shifting the way success is measured from evaluating a single transaction to making an overall assessment of the value of the entire relationship with your customer.

The customer lifetime value consists of two components: historical and predicted. The historical CLV is based on previous orders of a customer, while the predicted CLV is the expected future value of the customer. Since over 40% of businesses admit to struggle with any CLV calculation, we will focus here on setting a solid base for the historical CLV first. This basis can then be utilized for later predictions.

Who is it relevant for?

Customer Lifetime Value is a key metric for any business that implies multiple and somehow frequent transactions with the same customer.

Within those companies there are multiple stakeholders that can benefit from having a Customer Lifetime Value on customer level:

- CRM managers to improve customer segmentation

- CMOs to evaluate the effectiveness of their marketing mix and budget allocation

- Management to analyze cohorts’ development

- Marketing managers to draw conclusions from demographics and the behavior of high CLV segments, as well as to understand how much money they can spend on acquiring users (as opposed to blended CACs)

What do you need to calculate historical CLV?

As mentioned above, CLV is the cumulated profit margin of a customer (historical or expected). Why profit margin and not revenue? Simply because revenue doesn’t provide much insight on how well the unit economics is working. Some products yield low margins and we aim to identify the most profitable customers. However, as getting profit margin data per order can be challenging, calculating CLV based on revenue is also a good first step.

So, to calculate CLV for any given customer one would need to subtract all the variable costs associated with the transactions from the revenue made by it. Meaning: returns, cancellations, costs of goods sold, payment costs, shipping costs, vouchers etc. The bottom line is the value we’re looking for – and would be working with.

In the next step, we need to get all the marketing costs spent on the customer, from variable ones like AdWords and Facebook, to fix ones like cost of partnerships and collaborations. These costs then need to be distributed back to the traffic that has been generated.

For that, we need session data and a clear split between the costs of acquisition and reactivation. This split should be defined depending on the business model and acquisition goals. For e-commerce, it generally could be the first order of a customer, meaning all touch points prior to first order belong to the acquisition part of the journey, and the ones after it belong to the reactivation or retention part.

Keep in mind: the costs spent to acquire or reactivate one customer are not just the costs that successfully converted him, but also the costs of touch points from those campaigns that didn’t end in a conversion.

Since we are interested in the evaluation of individual customers and later on the prediction, we need to perform these calculations on the level of a single customer.

However, we need to differentiate between all-time CLV of a customer and CLV during a specific timeframe, like during the 30-90-180 days since the first order or initial registration. While the all-time CLV of a customer potentially is based on more data, having CLV data per time span allows us to compare the performance of different cohorts within the same durations, and reveals more about the customer base development over time.

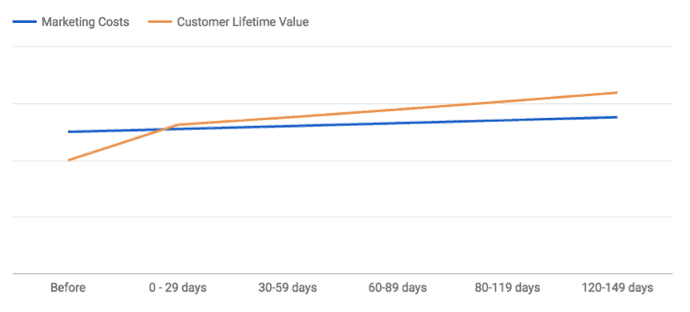

Once this is in place, we are able to analyze the cost and value development overall as well as for particular cohorts.

What to do with the findings?

Now, imagine that we know that the CLV for a specific customer goes up to 1.000€ within one year. What does it tell us and how can we leverage this knowledge? First, we need to put it into the context of marketing costs and further customer attributes, to be able to act on it. Combining the CLV progression over time with the marketing costs is a good start for understanding how soon after an acquisition we will break-even with this customer or customer group.

Well, if you’re done with this, it’s already a good start, but don’t stop here: Go on with segmenting your customer data to get real actionable insights. Here are some practical use cases of Customer Lifetime Value application:

- Are we getting better at acquiring and engaging the right customers?Compare how well differently aged cohorts perform in a certain time span. Choose a duration that is relevant for your particular business model, e.g.: are customers acquired in October’17 generating more profit margin in the first 30 days than customers acquired in September’17?

- What products attract the best customers?How profitable are the customers when broken down by the product category of the first order? Can similar results be seen when analyzing what kind of customers are acquired with different SEA campaigns or keywords?

- How the CRM approach be customized for different customer types?

For example: low CLV segments can be addressed via email, medium CLV segments will see a Facebook ad in their feed, while high CLV segments would find a personalized card in their mailbox.

When you figure out how to calculate and analyze the CLV of your customers, you lay a great foundation for your company to focus on getting the customers that have a positive impact on your bottom line. Drill them down by acquisition cohort, campaign, geography, first product category and customer segments in order to make the most out of your newly earned knowledge. In other words: eliminate the average whenever possible!

Find out more about data-driven marketing in our Project A Blog.

Like this article? Subscribe to our weekly newsletter to never miss out!